Chapter 6: Federal Wage Determinations

- 6-1 Introduction

- 6-2 Wage Determinations

- 6-3 Davis-Bacon Act Wage Determinations (Construction Projects)

- 6-4 Davis-Bacon Act Wage Decisions: Selection and Interpretation

- 6-4-1 Accessing the Correct DBA Wage Determination

- 6-4-2 Reading a Wage Decision

- 6-4-2(a) Cover Sheet (top section)

- 6-4-2(b) Record of modifications (bottom section of the cover sheet)

- 6-4-2(c) Classifications, Basic Hourly Rates, and Fringe Benefits

- 6-4-2(d) Classification Identifiers, Union Majority Prevailing and Survey Weighted Average

- 6-4-2(e) Union Identifiers

- 6-4-2(f) Modification History

- 6-5 Service Contract Act Wage Decisions: Selection and Interpretation

- 6-6 Federal Conformance

- 6-7 Incorrect Federal Wage Decisions

6-1 Introduction

If the applicable wage determination for a project does not include a classification and rate for a specific task, the required classification and wage rate must be added in conformance to the contract wage determination. This process occurs after the project has been advertised, awarded, or both.

The contracting agency must require that any class of laborers or mechanics not listed in the wage determination and who are employed on a DBRA-covered contract be classified in conformance with the wage determination.

6-2 Wage Determinations

6-2-1 Davis-Bacon Act and Davis-Bacon and Related Acts (Construction and Construction-related)

This Davis-Bacon Act (DBA) applies to federal contracts in excess of $2,000.00 for the construction, alteration, repair of public buildings or public works, or all, in which the federal government or the District of Columbia is a direct party to the contract.

The DBA also applies to construction-related contracts. One such example is the removal of trees to prepare the job site for construction. While separate from the actual construction tasks, it is technically part of the construction process and subject to the DBA if federally funded.

The DBA requires all contractors and subcontractors to pay onsite laborers and mechanics on the contract the prevailing wage rates and fringe benefits determined by the Department of Labor (DOL). Additionally, the DBA requires that certain labor standards provisions be specified in the contract awarded to the successful bidder in accordance with 29 CFR 5.5 (a), “Contract Provisions and Related Matters.” The applicable federal wage decision must also be included in the contract documents.

The Davis Bacon and Related Acts (DBRA) are federal statutes that allow for federal assistance through grants, loans, insurance, or guarantees for projects such as construction of hospitals, housing complexes, sewage treatment plants, highways, and airports. Included in the DRBA are references to the DBA labor standards provisions and the requirement that laborers and mechanics be paid prevailing wage rates

6-2-2 Service Contract Act (Services)

The Service Contract Act (SCA) applies to federal contracts in excess of $2,500.00 for services. Similar to the DBA, the SCA includes contracts entered into by the federal government and District of Columbia for contracts performed in the United States.

6-3 Davis-Bacon Act Wage Determinations (Construction Projects)

A wage determination is the listing of prevailing wage rates and fringe benefit rates for each classification of mechanics and laborers in a particular geographic area for a particular type of construction. Figure 6-A, “DBA Wage Determination Categories,” lists the four basic categories of wage determinations.

FIGURE 6‑A: DBA WAGE DETERMINATION CATEGORIES

| DBA Wage Determination Categories: |

|

There are four basic categories of wage determinations based on the type of construction.

A project that includes elements of two or more types of construction typically requires multiple wage determinations if such a category of construction is substantial, such as greater than 20 percent of project costs or greater than $1 million. |

6-3-1 DBA General versus Project Wage Determinations

There are two types of DBA wage determinations: general and project. Both include versions of the original decision and any subsequent decisions modifying, superseding, correcting, or otherwise changing the rates or scope of the original decision.

- General Wage Determinations:

- General wage determinations (GWD) apply to most counties nationwide for each general type of construction: building, residential, highway, and heavy. In some areas, separate schedules are issued for sewer and water line construction, for dredging, and for certain projects that would otherwise be categorized as heavy construction.

- GWDs contain no expiration date. Once issued, they remain valid until modified, superseded, or canceled. They may be used by the contracting agency, without previous notification to DOL, in contracts to be performed within a specified geographical area and for the types of construction designated in the wage determination.

- The Davis-Bacon general wage determinations and guidance for locating wage determinations are available at the following website:

- Project location

- The type of construction, whether it is a building, residential, highway, or heavy construction project for which the wage rates are needed

- Annual editions of the GWDs are issued in the first quarter of each calendar year. Each annual edition supersedes the previous GWDs, and the wage decision numbers reflect the year of a new edition.

- Any changes in wage rates on the GWDs are made in weekly updates, generally on Fridays, and are reflected in modification numbers on the GWD.

- DBA Project Wage Determinations:

- Project wage determinations are obtained on a case-by-case basis for individual projects that meet the following criteria:

- There is no general wage determination in effect for a county or type of construction needed for a proposed project

- The majority of the work on the project is to be performed by a classification that is not listed in the GWD that would otherwise apply to the project

- The bid opening and award has not yet occurred

- Requesting a project wage determination:

- Complete Standard Form 308 (SF308), “Request for Determination and Response to Request (DBA).”

- Form SF308 may be downloaded from the Forms section of the Wage Determinations web page.

- If the project involves multiple types of construction, attach information indicating the expected cost breakdown by type of construction.

- The time required for processing requests for a wage determination varies according to the circumstances of each request. An agency should anticipate that such processing will take at least 30 days.

- The completed Form SF308 should be sent to:

- Project decisions are applicable only to the particular project for which they are issued and are effective for 180 days. If a project decision is not used in the period of its effectiveness, it is void.

- If it appears that a wage determination may expire between bid opening and contract award, the agency should request a new project wage determination sufficiently in advance of the bid opening to assure receipt before bid opening.

SAM.gov | Wage Determinations. The wage rates are listed for each county of every state. There are two important criteria for searching the appropriate wage rates:

U.S. Department of Labor

Wage and Hour Division

Branch of Construction Wage Determinations

Washington, D.C. 20210

6-3-2 Davis-Bacon Act Modifications and Superseded Decisions

The GWDs and project wage decisions are subject to periodic updates. Wage decisions are typically updated for one of the following reasons:

- Apply the results of a new survey

- Update union rates to reflect collectively bargained changes in wage and fringe benefit rates for classifications for which negotiated rates have been determined to be prevailing for a given type of construction in the given geographic area.

Superseded wage decisions replace the previous GWDs and carry wage decision numbers that reflect the new year. Superseded decisions have a modification number of “0” followed by the date of issuance.

Modifications are listed numerically on the wage determination modification record for that year’s edition. The date of issuance of the modification follows the modification number. A modification to a GWD replaces the entire GWD that it modifies.

Selecting which version applies to a project depends upon factors discussed in Section 6.4, “Davis-Bacon Act Wage Decisions: Selection and Interpretation,” of this manual.

6-3-3 Identifying the Correct Davis-Bacon Act Wage Determination Version

It is important to select the most current wage determination and to include the decision in the bid or Request for Proposal (RFP) documents.

Negotiated contracts, RFPs, must include the most up-to-date wage determinations issued at the time of contract award and must be incorporated into Davis-Bacon covered contracts, in accordance with 29 CFR 1.6(c)(2)(i).

For contracts with competitive bidding procedures, the following rules apply:

6-3-3(a) The 10-Day Rule

The Caltrans 10-day rule is to issue a wage determination in an addendum 10 days before bid opening. This varies slightly from the 10-day rule under 29 CFR 1.6(a)(2)(i)(A), which allows the awarding body to revise the wage determination when there is less than 10 days to bid opening. For construction projects, however, fewer than 10 days before bid opening is often not sufficient time to revise a wage determination.

6-3-3(b) The 90-Day Rule

If a contract is not awarded within 90 days after bid opening, modification to a general wage determination in the contract must be effective to that contract, unless the agency receives special approval from the Department of Labor to make changes in accordance with 29 CFR 1.6(c)(3)(iv).

If, because of unavoidable circumstances, a project wage decision expires between bid opening and contract award, an extension may be requested in accordance with 29 CFR 1.6(a)(1).

“Modifications” to Davis-Bacon wage determinations and “supersedeas” wage determinations issued after award of a contract do not apply to a contract in accordance with 29 CFR 1.6(c)(2)(ii). Supersedeas wage determinations are issued annually to replace general wage determinations, or are issued in the previous edition of the publication, General Wage Determinations Issued Under the Davis-Bacon and Related Acts. Supersedeas wage determinations can be found on the Wage Determination website:

After bid opening and award of a contract, the DBA wage determinations cannot be modified, except if a correction of an inadvertent clerical error is issued pursuant to 29 CFR 1.6(b) and (c), reiterated in the Federal Acquisition Regulation (FAR) at 48 CFR 22.404-2 and 22.404-7. See also 29 CFR 1.6(b)(e), (f), and (g), and FAR at 48 CFR 22.404-9.

In pre-bid conferences, contractors should be instructed to review the DBA wage determinations in the bid documents, and to raise any questions or complaints during the bid advertisement and before bid opening.

6-4 Davis-Bacon Act Wage Decisions: Selection and Interpretation

All federal current and historical wage decisions are accessed through the Wage Determinations website at SAM.gov | Home.

6-4-1 Accessing the Correct DBA Wage Determination

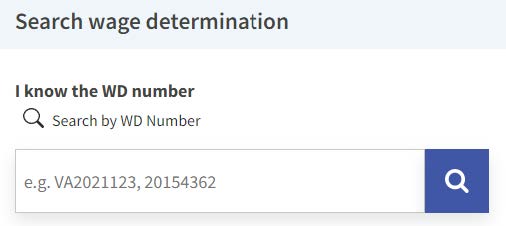

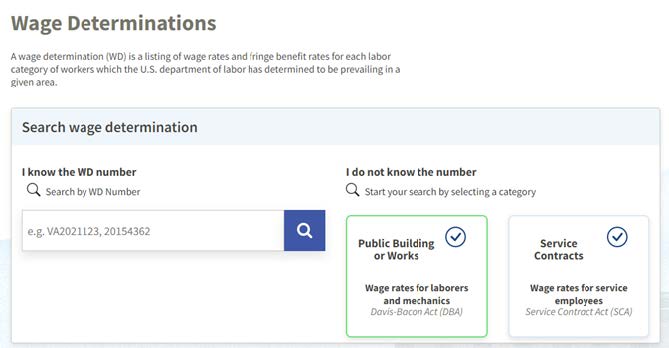

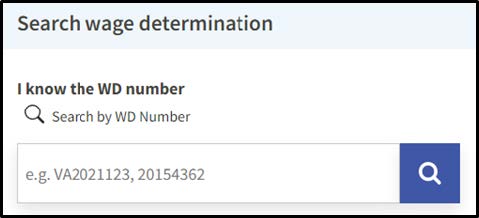

- From the SAM.Gov main page, select the Wage Determinations link.

- Search for the correct Wage Decision by entering the WD Number (if known).

- If you do not know the WD (wage decision) Number, search using the following selection criteria:

|

To search for a construction project wage decision, select: Public Building or Works |

|

|

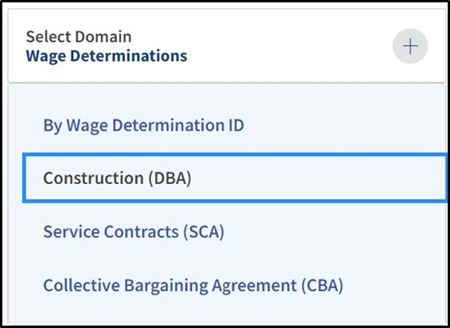

To narrow the selection criteria, select Construction (DBA) |

|

|

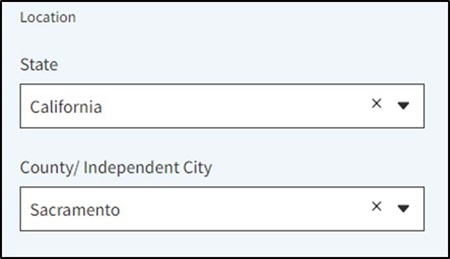

Using “Filter By” fields, select the appropriate option from the following dropdown menus: |

|

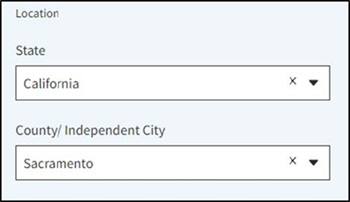

Location: Select the State and County in which the project is located.

|

|

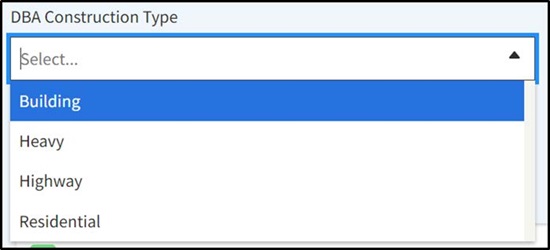

DBA Construction Type: Select the appropriate construction type of the project.

|

|

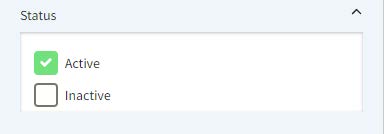

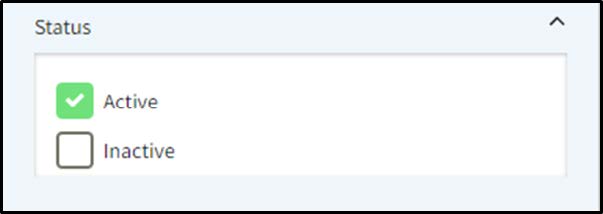

Status: In most cases, the status will remain at the default setting of “Active.” If you need an inactive wage decision, change the status accordingly.

|

|

Published Date: To further narrow the selection criteria, select the desired timeframe.

|

|

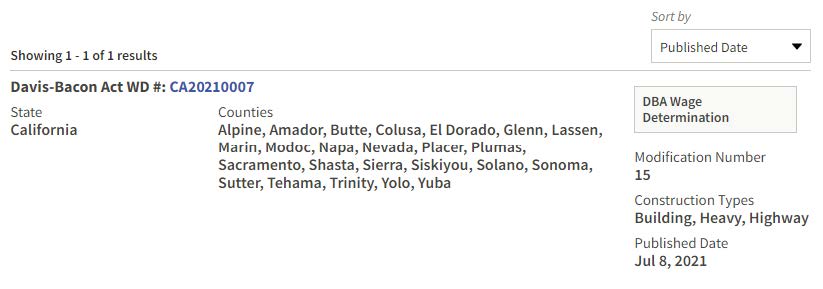

Based on the criteria selected, the applicable Wage Decisions will display below the filter boxes. The most recent will display at the top.

|

- Click on the Modification Number to display the entire wage decision.

6-4-2 Reading a Wage Decision

To assure that laborers and mechanics employed under a contract are paid the correct locally prevailing wages and fringe benefits for corresponding work on similar projects in the area, it is imperative to properly interpret a general wage decision by understanding the following for areas:

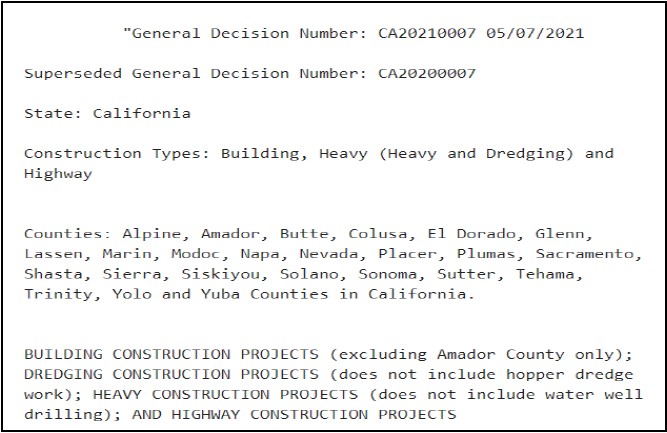

6-4-2(a) Cover Sheet (top section)

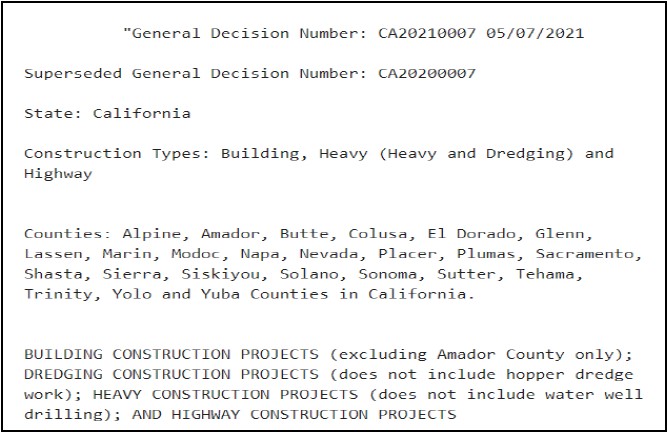

FIGURE 6‑B: TOP SECTION OF COVER SHEET

6-4-2(b) Record of modifications (bottom section of the cover sheet)

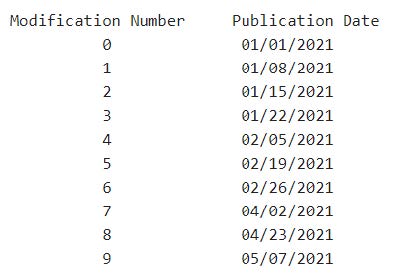

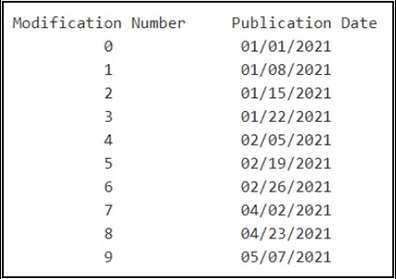

FIGURE 6‑C: RECORD OF MODIFICATIONS

6-4-2(c) Classifications, Basic Hourly Rates, and Fringe Benefits

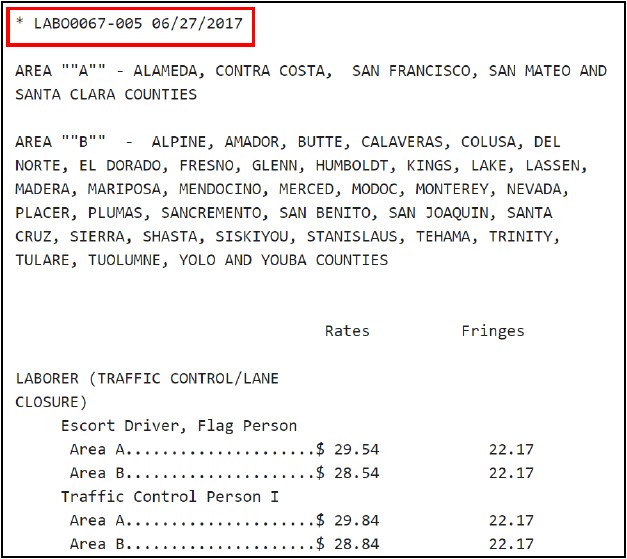

In the body of each wage determination is the listing of classifications for laborers and mechanics and accompanying basic hourly wage rates, and fringe benefit rates that have been determined to be prevailing for the specified type of construction in the geographic areas covered by the wage determination.

Classification listings may also include classification groupings, fringe benefit footnotes, descriptions of the geographic areas to which sub-classifications and different wage rates apply, or certain classification definitions.

An alphanumeric identifier, as well as a date, is listed above each classification or group of classifications that provide information about the source of the classification and wage rate listed for it.

In wage determination modifications, an asterisk is used to indicate that the item marked is changed by that modification.

FIGURE 6‑D: CLASSIFICATIONS AND HOURLY RATES

6-4-2(d) Classification Identifiers, Union Majority Prevailing and Survey Weighted Average

Each wage determination contains the prevailing wage rates for the cited type of work in the specified geographic area as well as classification identifiers. The classifications are listed in alphabetical order of “identifiers” that indicate if the rates are union majority or survey weighted average wage rates.

Some wage determinations contain only survey weighted average wage rates, some contain only union-negotiated majority wage rates, and others contain both union majority and survey weighted average wage rates that have been found to be prevailing in the area for the type of construction covered by the wage determination.

6-4-2(e) Union Identifiers

An identifier beginning with characters other than SU denotes that the union classifications and wage rates have been found prevailing. The first four letters indicate the international union for the local union that negotiated the wage rates listed under that identifier. The four-digit number that follows indicates the local union number.

6-4-2(f) Modification History

The last section of each wage decision displays the modification history list of superseded decisions. Staff may have to open the decision to verify it is the correct publication date.

FIGURE 6‑E: MODIFICATION HISTORY

6-5 Service Contract Act Wage Decisions: Selection and Interpretation

All federal current and historical wage decisions are accessed through the wage determination website at SAM.gov | Home.

6-5-1 Accessing the Correct Service Contract Act Wage Determination

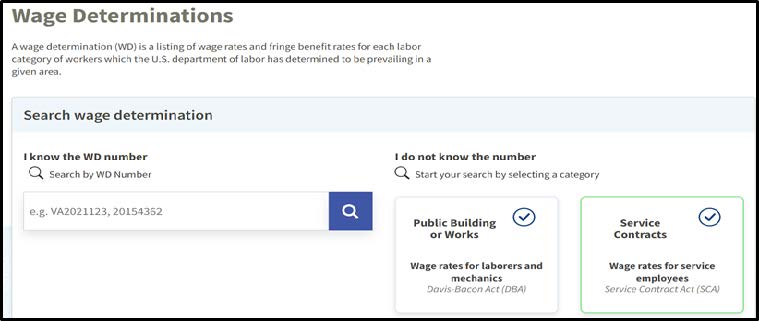

- From the SAM.Gov main page, select the wage determinations link.

- Search for the correct wage decision by entering the WD, or wage decision, number, if known.

- If you do not know the wage decision number, search using the following selection criteria:

|

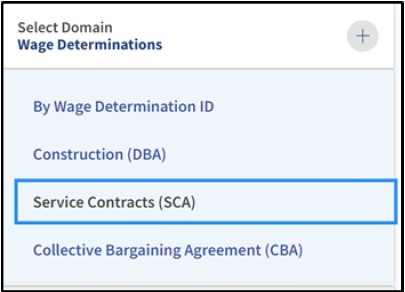

To search for a Service Contract wage decision, select Service Contracts. |

|

|

To narrow the selection criteria, select Service Contracts (SCA) |

|

|

Using “Filter By” fields, select the appropriate option from the following dropdown menus: |

|

Location: Select the State and County in which the project is located.

|

|

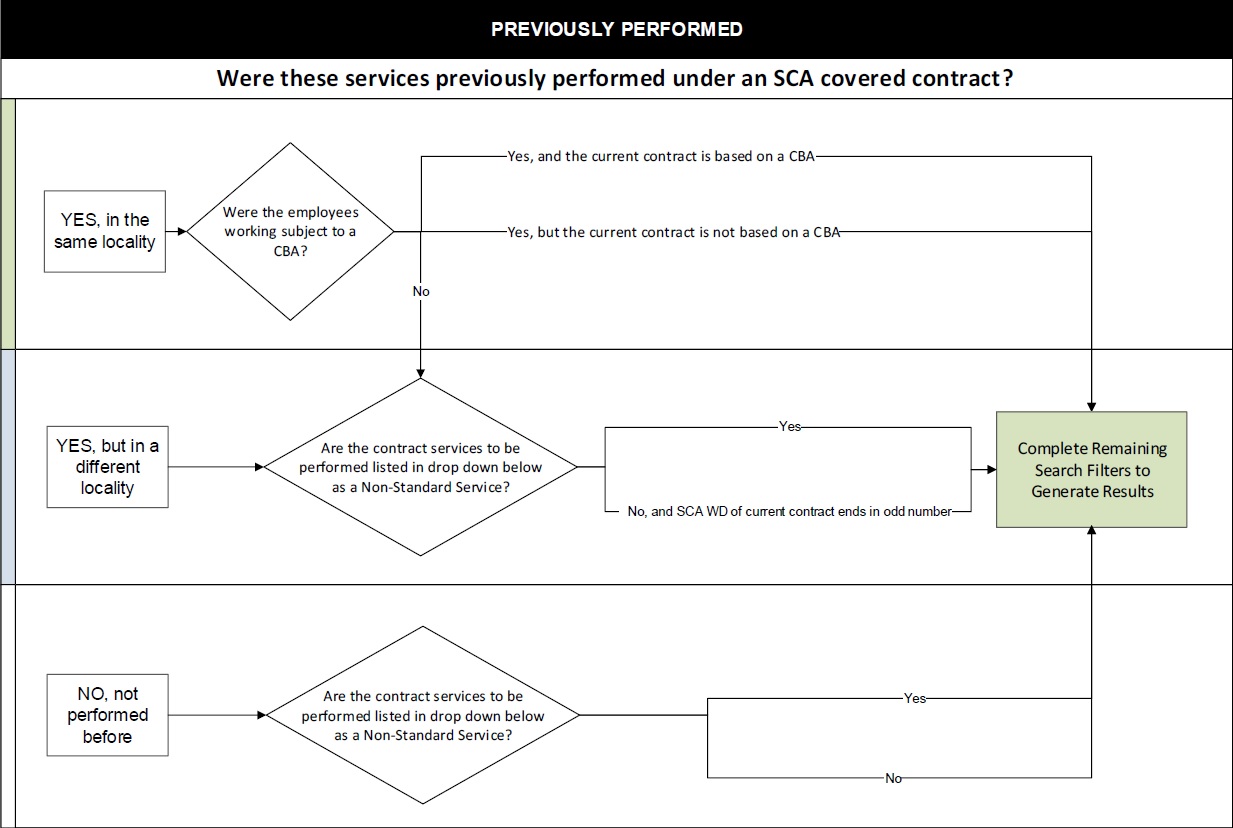

Previously Performed: Select the applicable designation and applicable search criteria as shown in Figure 6-F, “Restitution Process Overview.” |

FIGURE 6‑F: RESTITUTION PROCESS OVERVIEW

|

Status: In most cases, the Status will remain at the default setting of Active. If you need an inactive wage decision, change the status accordingly.

|

|

Published Date: To further narrow the selection criteria, select the desired timeframe.

|

|

Based on the criteria selected, the applicable Wage Decisions will display below the filter boxes. The most recent will display at the top. |

- Click on Modification Number to display the entire wage decision.

6-5-2 Reading a Wage Decision

To ensure that laborers and mechanics employed under a contract are paid the correct locally prevailing wages and fringe benefits for corresponding work on similar projects in the area, it is imperative to properly interpret general wage determination by understanding the following for areas:

Cover Sheet, top section

FIGURE 6‑G: TOP SECTION OF COVER SHEET

Record of modifications, bottom section of the cover sheet

FIGURE 6‑H: RECORD OF MODIFICATIONS

6-6 Federal Conformance

If the applicable wage determination for a project does not include a classification and rate for a specific task, the required classification and wage rate must be added in conformance to the contract wage determination. This process occurs after the project has been advertised or awarded.

The contracting agency must require that any class of laborers or mechanics not listed in the wage determination and who are employed on a DBRA-covered contract be classified in conformance with the wage determination.

6-6-1 Conformance Criteria

- The classification must be appropriate for the contract work.

- The proposed new classification cannot combine job duties from two or more existing classifications on the wage determination or propose a new classification that performs only part of the duties of an existing classification.

- The proposed classification cannot be trainee or helper.

- The proposed wage rate for the new classification should generally be no lower than the wage rate of the lowest skilled classification on the determination.

- Conformance requests should not be submitted for exempt classifications, such as project managers, full-time supervisors, or professionals such as engineers.

- The proposed rate should bear a reasonable relationship to the wage rates listed on the wage determination. The proposed fringe benefits should be the same as listed on the wage determination.

6-6-2 Conformance Process, Agency Role

- Pre-Bid or Pre-Award

- Review the wage determination

- Compare classifications on the wage determination with proposed work to be performed.

- If most of the work is to be performed by one missing classification, use Standard Form (SF) 308 to request an appropriate predetermined wage rate for incorporation in the bid specifications.

- Notify contractors about the possible need to request additional classes and rates after award:

- Verify that Davis-Bacon provisions are in the solicitation, including the conformance criteria. See 29 CFR 5.5(a) and FAR at 48 CFR 22.407 and 52.222-6(c).

- Discuss the possibility of additional classifications during pre-bid or pre-award conferences.

- Explain how requests for additional classifications are processed and proposed wage rates will be evaluated.

- After contract award

- Review wage determination and conformance criteria at the pre-construction conference.

- Review certified payrolls for classifications not listed on the wage determination.

- Remind contractors to communicate information about missing classifications and rates to subcontractor.

- Work with contractors and other affected parties to help with the conformance request:

- Provide Form SF-1444, “Request for Authorization of Additional Classification and Rate,” or similar to the contractor. Instructions are on the form. Form SF-1444 can be downloaded from the Forms section on the Wage Determinations website at:

- Review the contractor’s request for additional classes and rates in accordance with conformance criteria.

- Determine whether affected parties are in agreement.

- Attempt to resolve disputes in accordance with conformance criteria, if possible.

- Develop agency recommendation and documentation of any disputes.

https://sam.gov/content/wage-determinations

6-6-3 Submit Conformance Request

- Complete Form SF-1444, or similar form, or letter, including:

- Related documentation and agency recommendation.

- Copy of contract wage determinations. The Department of Labor’s Wage and Hour Division policy requires the submission of the contract wage determination with the conformance request.

- Submit the request by email or fax.

- Scan the completed form and all supporting documents into a .PDF document and attach to the email. Include the contracting officer's name, address, telephone number, and email address. Submit the email to: WHD-CBACONFORMANCE_INCOMING@dol.gov.

- An automated confirmation response will be generated upon receipt of your submission.

- Communicate with DOL after submitting conformance request, as appropriate:

- Lack of a DOL response within 30 days does not mean that the request has been approved.

- All conformances are processed, and responses are issued to the contracting agency by email.

6-6-4 Department of Labor Review Process

- The Department of Labor (DOL) Wage and Hour Division (WHD) reviews the request for conformance based upon information submitted and criteria.

- Checks that the requested classification is listed on the wage determination or that a classification on the wage determination can perform the work.

- If not listed, determines that the proposed rate bears a reasonable relationship to the rates already in the contract wage determination

- Verifies that the classification is used by the construction industry

6-6-5 Wage and Hour Division Decision

- Upon receipt of the decision, agency communicates decision to contractor and other interested parties.

- Agency advises parties of reconsideration and appeal process.

6-7 Incorrect Federal Wage Decisions

6-7-1 Post-Bid Advertisement for Federal Wage Rate Decisions

When a wage determination containing clerical errors is issued, the DOL administrator may, upon their own initiative or at the request of an agency, correct any wage determination. Corrections are included in any bid specifications containing the wage determination, or in any ongoing contract containing the wage determination in question, retroactively to the start of construction.

Caltrans may terminate the contract and reopen the bid process with the valid wage determination or incorporate the valid wage determination retroactive to the beginning of construction through supplemental agreement or through a change order. The contractor should be compensated for any increases in wages resulting from a wage determination change. For further information, refer to 29 CFR Part 1, Section 6.

6-7-2 Wage Determination Appeals Process

Wage determinations may be appealed if it is believed the rates do not accurately reflect those prevailing in the area. Requests must be submitted in writing accompanied by supporting data:

Wage and Hour Administrator

United States Department of Labor

200 Constitution Avenue, N. W.

Washington, D. C. 20210

The Wage and Hour Division should respond within 30 days or notify the requestor within this time frame that additional time is needed.

Requestors include, without limitation:

- Any contractor, or an association representing a contractor, that is likely to seek or to work under a contract containing a particular wage determination, or any laborer or mechanic, or any labor organization that represents a laborer or mechanic who is likely to be employed or to seek employment under a contract containing a particular wage determination.

- Any federal, state, or local agency concerned with the administration of a proposed contract or contract containing a particular wage determination issued pursuant to the Davis-Bacon Act or any of its related statutes.

If reconsideration of a wage determination has been sought and denied, an appeal for review of the wage determination or its application may be filed with:

Administrative Review Board

U.S. Department of Labor, Room N-1651

200 Constitution Avenue, N.W.

Washington, D.C. 20210

All decisions by the Administrative Review Board are final.

Labor Compliance Manual Chapters

Chapter 1 - History, Laws and Regulations Governing Prevailing Wage Requirements

Chapter 2 - Governing Agencies

Chapter 3 - Caltrans Labor Compliance Program and Related Requirements

Chapter 4A - Division of Construction-Administered Contracts

Chapter 4B - Other Division-Administered Contracts

Chapter 5 - State Wage Determination

Chapter 6 - Federal Wage Determinations

Chapter 7 - Labor Compliance File

Chapter 8 - Pre-Job Conference Requirements and Posters

Chapter 9 - Determining Prevailing Wage Covered Work

Chapter 10 - Classification of Labor and Required Rates of Pay

Chapter 11 - Apprentice Requirements

Chapter 12 - Federal Trainee Requirements

Chapter 13 - Weekly Certified Payroll Records

Chapter 15 - Payroll Review and Confirmation

Chapter 17 - Notification Process

Chapter 18 - Employee Interviews and Equal Employment Opportunity (EEO) Compliance

Chapter 19 - Complaints Process

Chapter 20 - Audits and Investigations Process

Chapter 21 - Wage Case Submittal

Chapter 22 - Restitution Collection