Chapter 24: Completion of Project/Closeout

24-1 Closeout Process

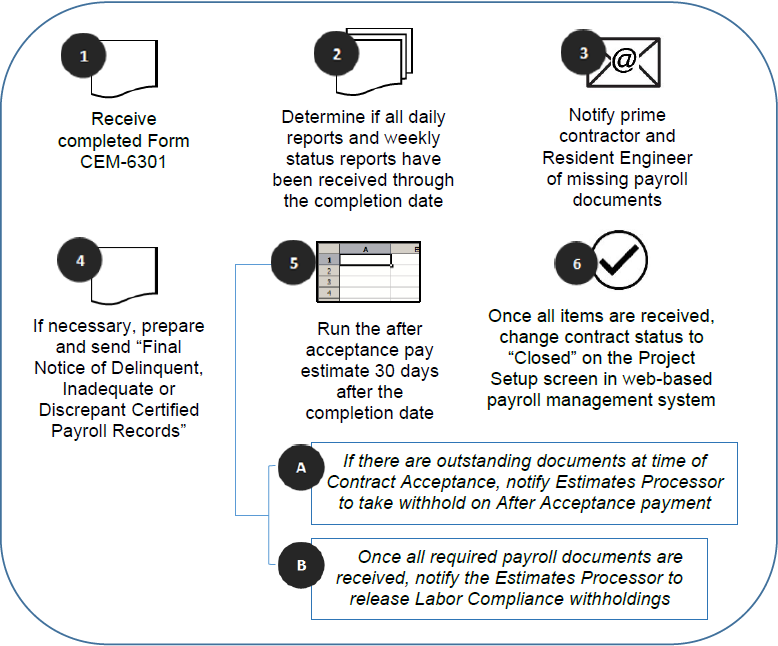

Once a project has been completed, the following steps are taken to confirm that all outstanding issues have been resolved and missing documentation was requested and received:

- Receive completed Form CEM-6301, “Contract Acceptance.”

- Determine if all daily reports and weekly status reports have been received through the completion date. If not, contact the resident engineer and request immediate submission.

- Notify the prime contractor and the resident engineer of missing payroll documents.

- Prepare and send Final Notice of Delinquent, Inadequate or Discrepant Certified Payroll Records for any delinquent, inadequate or discrepant payrolls still outstanding at the time of contract acceptance.

- Delinquent

- Inadequate and Discrepant

- A supplemental certified payroll

- A signed statement of compliance

- A copy of the front and back of the canceled checks

- Run the after-acceptance pay estimate 30 days after the completion date.

- If there are missing documents or payroll records at the time of contract acceptance, notify the estimates processor to take a withhold on the after acceptance payment to cover any deductions because of these missing items.

- Once all required payroll documents are received, notify the estimates processor to release any labor compliance withholdings in place.

- Once all items are received, change the contract status to “Closed” on the project setup screen if the project is subject to submission of payrolls using a web-based payroll management system.

For delinquent certified payroll records, in accordance with California Labor Code Section 1776(h), the prime contractor is notified that failure to provide payrolls to Caltrans within 10 days from receipt of this request will be subject to a penalty of $100 for each calendar day, or portion thereof, for each worker, until the required payrolls have been received. Similarly, subcontractors are notified using this letter.

For inadequate and discrepant certified payroll records, the prime contractor is instructed to provide:

Failure to provide these documents within 10 days from the receipt of the inadequate final notice or discrepant final notice, a wage violation case to the Division of Construction Labor Compliance unit and submit a formal forfeiture request to DIR.

FIGURE 24‑A: CLOSEOUT PROCESS

Additional Consideration:

Any source document audit reviews in process at the time of contract acceptance are subject to an 18-month statute of limitations from the time of acceptance. It is imperative that source document audit reviews are processed in a timely manner after contract acceptance.

24-2 Project Archive Process

When the resident engineer completes a project, the project files will be taken district to be archived. Depending on the project size, there can be anywhere from 2 to 30 banker boxes of all printed documentation related to the project.

Districts will send the Category 25, “Labor Compliance and Equal Employment Opportunity,” records that they have been maintaining with the resident engineer’s documentation to their respective Construction Administration team to be compiled, organized and archived in a secured location for a period of three years. Maintaining records allows districts to be able to locate information on completed projects in the event there is an audit or investigation.

After the 3-year period, the Construction Administration team will purge and destroy the records.

For projects subject to submission using the web-based payroll management system, the system maintains the records, and they will not need to be added to the project hard copy files to be archived.

24-2-1 Electronic Records

To reduce the amount of paper, districts have been moving to implement electronic maintenance methods of project history documents, which includes the project award summary, pre-job checklists, certified payroll records and fringe benefit statements.

With the implementation of the web-based payroll management system, districts will be maintaining all payroll records and requested documentation from the contractor electronically as long as headquarters requires.

Labor Compliance Manual Chapters

Chapter 1 - History, Laws and Regulations Governing Prevailing Wage Requirements

Chapter 2 - Governing Agencies

Chapter 3 - Caltrans Labor Compliance Program and Related Requirements

Chapter 4A - Division of Construction-Administered Contracts

Chapter 4B - Other Division-Administered Contracts

Chapter 5 - State Wage Determination

Chapter 6 - Federal Wage Determinations

Chapter 7 - Labor Compliance File

Chapter 8 - Pre-Job Conference Requirements and Posters

Chapter 9 - Determining Prevailing Wage Covered Work

Chapter 10 - Classification of Labor and Required Rates of Pay

Chapter 11 - Apprentice Requirements

Chapter 12 - Federal Trainee Requirements

Chapter 13 - Weekly Certified Payroll Records

Chapter 15 - Payroll Review and Confirmation

Chapter 17 - Notification Process

Chapter 18 - Employee Interviews and Equal Employment Opportunity (EEO) Compliance

Chapter 19 - Complaints Process

Chapter 20 - Audits and Investigations Process

Chapter 21 - Wage Case Submittal

Chapter 22 - Restitution Collection