Chapter 20: Audits and Investigations Process

- 20-1 Introduction

- 20-2 Initiation

- 20-3 Scheduling the Audit

- 20-4 Audit Preparation

- 20-5 Conducting the Audit

- 20-6 Completion of Audit and Notification of Audit Findings

- 20-6-1 Failure to Provide Records

- 20-6-2 Receipt and Review of Supplemental Records

- 20-6-3 When the Contractor Fails to Resolve Violations

- 20-6-4 When a Contractor Fails to Comply with an Audit

- 20-6-5 When the Statute of Limitations Expires

- 20-6-6 Investigative Interviews

- 20-6-7 Disputes

- 20-6-8 Wage Cases

- 20-7 Audit Completion and Close of Investigation

20-1 Introduction

An audit enables the Labor Compliance office to determine compliance with the requirements of the California Labor Code and the federal Davis-Bacon Act requirements. Its purpose is to determine:

- If wage rates and hours reported on the certified payrolls are true and correct

- That the classifications of workers employed on the project are supported by factual evidence provided by the contractor.

The LCO may conduct an audit when any of the following conditions exist:

- Discrepancies between the certified payroll records and assistant resident engineer’s daily reports, fringe benefit statements, or apprentice agreements

- Missing payroll records

- Evidence of falsified payroll records

- Receipt of employee complaints

- Discrepancies on employee interviews

- Receipt of statements from contractor employee of possible wage violations

- Discrepancies between extra work bills and the certified payrolls

- Complaints received

- Contractor history of violations

- DIR referral

The evidence gathered at the audit is used to calculate wage restitution due to workers and any penalties for wage underpayment.

Each district or region’s Construction Labor Compliance staff is responsible for performing an audit for each contract whether or not the contractor’s home office is within the geographic boundaries of the district or region where the work is performed.

Headquarters Labor Compliance unit performs any audit and investigation activities for any non-Construction division contracts.

NOTE: Current letter templates referenced in this chapter can be accessed on the Caltrans Labor Compliance intranet site.

20-2 Initiation

The first step is to send the Notice of Source Document Audit, also known as the 30-Day Audit Notice, to the prime contractor and affected subcontractors and request documents that cover the entire time period the contractor has worked on the contract. Source documents requested and used as evidence are defined in California Code of Regulations, Title 8, Section 16000 (8 CCR 16000), “Definitions.” Refer to the Headquarters Labor Compliance intranet website for the 30-Day Audit Notice templates for construction projects and service contracts.

Construction Labor Compliance Letter Templates (ZIP)

If the project is ongoing:

- The request will be for the time period to the date of the notification

- Additional documents can be requested later with another notification

Source document audit evidence is any type of supporting documentation including:

- Cancelled checks

- Earnings statements, such as itemized wage statements or payroll vouchers

- Accounting records

- Bank statements

- Time cards

- Foreperson’s journals

- Trust fund statements

A minimum of 10 days are given for the prime contractor and affected subcontractor to submit the requested items pursuant to California Labor Code Section 1776.

Collect and organize documents, such as payroll records, fringe benefit statements, or daily reports, previously submitted by the contractor.

Gather additional items needed once the audit documents are received, including:

- DIR prevailing wage determinations

- Associated travel, shift, and holiday provisions

- The bid item list

- The first page of special provisions

- A copy of the pre-job checklist

- Pre-construction meeting sign-in sheet

20-2-1 If Documents are Not Received

If a contractor does not comply with the request by the due date:

- The Labor Compliance unit should contact the contractor to determine whether the documents had been sent.

- The Labor Compliance unit will send the Final Notice – Failure to Comply with Audit letter. Refer to the headquarters Labor Compliance intranet website for the Final Notice templates to be sent to the prime contractor and any subcontractors.

https://construction.onramp.dot.ca.gov/letter-templates

- If the contractor does not comply after 10 calendar days from the date of the Final Notice letter, prepare a wage case for failure to furnish records for submission to headquarters.

20-2-2 If the Contractor Requests an Extension

If the contractor’s request for an extension is approved, send the Approval of Request for Extension letter.

- If the contractor complies with the extension, refer to Section 20-2-3, “When Documents are Received,” of this manual.

- If the contractor fails to provide the records by the new due date, refer to Section 20-2-1, “If Documents are Not Received,” of this manual.

If the request for an extension is denied, send the Request for Extension Denied letter and prepare a wage case for failure to furnish records for submission to headquarters.

20-2-3 When Documents are Received

When the requested documents are received by the Labor Compliance office:

- Send the Initial Receipt of Audit Records letter to the prime contractor and subcontractor, identify which documents were included in the submission and which, upon initial review, were not provided.

- Sort the documents into a binder or file that is separated by week-end date to allow for an easier review once the audit process begins.

The first section of the binder should include copies of the applicable DIR prevailing wage determinations and associated travel, shift, and holiday provisions, the bid item list, the first page of the special provisions, a copy of the pre-job checklist and pre-job meeting sign-in sheet, and fringe benefit statements.

The trust fund statements, and proof of payment are placed in their own section. Every case is different, but it is generally easier to review the documents when the payroll records, supporting check stubs, cancelled checks, and daily reports are sorted by week-end date.

20-3 Scheduling the Audit

In accordance with California Labor Code Section 1741, Caltrans enforcement authority extends to 18 months from contract acceptance or completion. Caltrans must have all audits and investigations completed and submitted to DIR before this date.

When a complaint is received or a potential violation is suspected, check the estimated completion date of the project. Depending on the estimated contract completion date, the Labor Compliance officer may have to rearrange date priorities to accommodate projects that are ending soon. Assign a priority to each investigation.

Request that the Division of Construction Labor Compliance unit determine if another district Labor Compliance office has completed an audit of this contractor recently, and request information regarding the outcome. If another district or region is in the process of scheduling an audit, the Labor Compliance officer should contact that district and coordinate the reviews.

20-3-1 Scheduling Letter

Send the prime contractor a letter by certified mail that includes the scheduled date, time, and location of the audit. Request a return receipt. Direct all correspondences to the prime contractor, and if affected, the subcontractor.

The Labor Compliance officer should mail the scheduling letter early enough to allow no more than 10 working days between the anticipated receipt of the letter and the audit. If the contractor refuses to accept certified mail, send a copy of the audit scheduling letter by first class mail showing service of process by mail.

The certified scheduling letter should request that the contractor furnish:

- All payroll records, including:

- Time cards

- Foreperson logs

- Payroll journals

- Payroll vouchers

- Cancelled checks

- Check stubs

- W-2s

- Trust fund statements, verification of payment, and a list of covered employees, if applicable.

- Documentation of travel and subsistence payments, if applicable.

- State Form DE-9, “Quarterly Contribution Return and Report of Wages under the Unemployment Insurance and Revenue Taxation Codes.”

20-4 Audit Preparation

Before conducting the audit, prepare the following forms and information:

- Form CEM-2508, “Contractor Payroll Source Document Audit Summary”

- This form summarizes contractor payroll source document audit activities. Details on how to complete this form are included on the second page of Form CEM-2508.

- Form CEM-2509, “Checklist — Source Document Audit”

- This form is used when verifying payroll records reviewed during a source document audit. Instructions on how to complete this form are on the third page of Form CEM-2509.

- If a wage case is prepared as a result of an audit, submit Form CEM-2509 to the Division of Construction Labor Compliance unit.

- Determine correct prevailing wages

- On the contract special provisions, use the date of advertisement on the lower left-hand corner below the bid opening date

- Copy the state prevailing wage pages that were in effect at the time of advertisement for the crafts, or classifications that are to be used on the project.

- Copy any subsequent state prevailing wage rate pages on any of these wage rates that have a double asterisk.

- If federal funds are involved, check federal rates referred to in the contract special provisions and any existing addendum against the state rates and use the higher of the two.

- Check the subsistence map by classification to see if the project is in a subsistence area.

- Check in the DIR, Division of Labor Statistics and Research website for travel requirements by classification.

20-4-1 Contract Records used for the Audit

Gather the following documents for the wage case file or binder to complete the audit:

- Form CEM-2501, “Fringe Benefit Statement”

- Contractor certified payrolls

- Form CEM-2503, “Statement of Compliance”

- Form CEM-2504, “Employee Interview: Labor Compliance / EEO," or CEM-2502 (Spanish), “Entrevista del Empleado: Cumplimiento Laboral / IOE,” (do not show to the contractor)

- Form CEM-2506, “Labor Compliance Wage Violation,” if any documents have been completed

- Form CEM-2507, “Labor Violation: Case Summary”

- Form CEM-2508, “Contractor Payroll Source Document Audit Summary”

- Form CEM-2509, “Checklist — Source Document Audit”

- Apprentice agreements

- Form CEM-4601, “Assistant Resident Engineer’s Daily Report”

20-5 Conducting the Audit

Audits may be completed by examining records at the contractor’s office, or records sent by mail to Labor Compliance or submitted electronically. For staff safety, however, it is encouraged for records to be received by mail or electronically submitted.

Complete the audit with documents that have been submitted even if complete records have not been furnished. An audit of the records received should still be performed and any delinquent records should be identified in an Audit Findings letter as detailed in Section 20-6, “Completion of Audit and Notification of Audit Findings,” of this manual.

Received audit documents differ for each contract and identified issue. Each week should be reviewed and listed on Form CEM-2506, “Labor Compliance Wage Violation,” to document the review process and compile findings. Instructions for completing this form are included on the second page of the form.

The Labor Compliance office should verify every aspect of prevailing wage requirements for each week being audited. The following items provide an overview of what should be identified and verified by the auditor.

Check All Payroll Records

- Itemized wage statements, for example, check stubs, should be examined to confirm they match the copies of the cashed checks, and all math should be verified to confirm accuracy.

- The amounts documented on itemized wage statements should be added to Form CEM-2506 as what the contractor has paid.

- If items like subsistence, travel, and fringes were paid in cash to the employee, they should also be verified on the itemized wage statement.

- To verify hours worked, compare the daily reports to the timesheets submitted by the contractor. Determine whether the type of work each employee has performed is correctly classified.

- If daily reports are not available, verify that the timesheets match the contractor’s itemized wage statement. This is a common place to locate inconsistencies in an audit, and careful attention should be paid to the cross-reference of timesheets, daily reports, and itemized wage statements.

- It is important to add the hours paid only after a review of the itemized wage statement has been completed. Then the hours paid at the rates as shown on the itemized wage statement should be added to Form CEM-2506 as the contractor’s hours paid.

- If fringe benefits were paid to a fund, examine each month of trust fund statements. Trust fund statements must be accompanied by copies of cashed checks, and the amounts on the statements should match these checks.

- Statements need to be reviewed against employees documented as working on the audited contract. The hours on the trust fund statement must be equal to or exceed those worked on the audited contract. If they do not match, there may be an underpayment of fringes.

- Careful consideration should be taken to verify that the actual amounts paid for each employee are calculated accurately. These amounts should be added to Form CEM-2506 as the fringe benefits and training paid on behalf of that employee.

- For the Caltrans side of Form CEM-2506, it is important to use Caltrans records, such as daily reports, to determine the hours worked. In most cases, the timesheets of the contract are more accurate, and issue should be raised when there are marked discrepancies between the contractor’s timesheets and the daily reports; the Caltrans inspector can verify the hours as documented on the daily reports are accurate.

- The wage rates included on the Caltrans side of Form CEM-2506 should be pulled from DIR based on the advertised date of the contract. It is imperative that these amounts are accurately calculated, especially if there were increases that took effect for the classification listed by the contractor.

Time Cards

When examining paper records, determine whether time cards are originals, written in different hands, at different times, or appear to be written by the same person.

Review any notations written on the cards, such as:

- The type of work performed

- “No lunch”

- “Plus other jobs”

- “Minus expenses” or similar notations

Note who signed the time cards, and if the time cards contain hours for more than one project. Verify that the time cards match the payrolls and earning statement documentation. If time cards do not show hours for all projects worked for the week, ask for those records. If an employee only worked part of the week on the project, the Labor Compliance officer cannot verify payment of prevailing wages without seeing all the hours for the week.

Payroll Journals

Request payroll journals to verify how the contractor calculated the wage rate.

The contractor transfers hours from the time cards to payroll journals, which are individual employee records, in order to:

- Calculate the employee’s wages

- Track project breakdown for cost of project

- Keep individual employee records for the year to send out the W-2s

Trust Fund Statements

Trust fund statements show the monthly payments a contractor makes and can be used to verify hours that were paid on behalf of the employee. If a contractor is reporting too few hours or wages, review trust fund statements for similar violations. Ask to see cancelled checks for trust fund deposits.

Signatory contractors’ trust fund statements would be payments made to the union. Non-signatory contractors may have private pension plans or health insurance. Verify payments to these funds. If they are monthly payments, hourly rates should be calculated by dividing the amount paid by the working hours.

For full time employees, refer to the annualization method covered in Section 4.2.6 of the DIR Public Works Manual. Divide the annual rate of construction (yearly) total by 2,080 hours.

Example of annualization: A monthly medical contribution of $400 over 12 months equals $4,800; divide $4,800 by 2,080 hours, to determine an hourly credit of $2.307

Deductions

Any deductions from the employees’ pay should be verified to be lawful deductions. Deductions include items such as retirement, health benefits, and contractor administered vacation or leave policies.

- If deductions are taken from the employee’s pay for something other than employment taxes, ask to see proof of payment to the third party, such as checks made out for court-ordered payments or 401K plans.

- Training funds are not paid to the worker and should not be included as a deduction. Training funds are paid to the local training trust fund of an approved apprenticeship program, or to the California Apprenticeship Council (CAC) submitted on Form CAC 2, “Training Fund Contributions.”

Verify Travel and Subsistence

If travel and subsistence is required on the project, they should be verified as paid on the certified payroll or fringe benefit statement. On occasion, items such as hotel receipts and mileage logs will need to be requested and reviewed to verify the DIR travel and subsistence requirements were met.

Cancelled Checks

Examine cancelled checks for:

- Signature – Determine if the signature on the back of the check is consistent each week, or if it may have been made by someone other than the employee.

- Bank account number – Determine if the check goes into the same account each week. Confirm it is not deposited back into the employer’s account.

- Cashed checks have a computer-generated number showing the amount of cashed check located in the lower right-hand corner of the check. Confirm that the computer-generated number matches the amount the check was written for.

- If a check is stamped “insufficient funds,” ask to see the replacement check. Confirm the replacement check is for that work and not work done later or for another project.

- Compare checks against the certified payrolls. If the certified payrolls are fraudulent, and do not represent the actual payroll records, use the certified checks to determine what was actually paid.

- Itemized wage statements, such as check-stubs, earning statements, payroll vouchers, should show the hours worked and the wages paid for the week. The Labor Compliance officer should compare the payroll records and cancelled checks with wage statements that an employee has furnished to them if they are available

- If cancelled checks cannot be located, look at bank statements to compare against the checkbook.

Direct Deposit

When employees are paid by direct deposit, the following items need to be requested:

- Copies of their signed direct deposit enrollment forms, account number can be redacted except for last four digits

- Copies of their itemized wage statements, such as, check-stubs, earning statements, payroll vouchers

- Business banking records showing the outgoing payments to the employee’s account

In some cases, a payroll journal showing itemized payments and business banking records showing a lump sum equal to the total of the payroll journal listing may also be accepted.

20-6 Completion of Audit and Notification of Audit Findings

Once the audit has been performed on all submitted records, complete an Audit Findings letter, identifying any:

- Violations found

- Delinquent records

- Inadequate records

- Underpayment of wages

- Other discrepancies identified

The Audit Findings letter template can be found on the headquarters Labor Compliance intranet website. Include the following:

- Send the completed Audit Findings letter to the prime contractor. If you need to confer with the resident engineer or follow up on any information, inform the contractor and estimate a response date.

- Establish deadlines for any actions that the contractor must take.

- Provide the opportunity to resolve a wage underpayment to the prime contractor or offending subcontractor.

- If the problems found were unintentional and this is the contractor’s first offense, allow the contractor to make restitution to the employees, furnish copies of the cancelled checks, copied both front and back, and submit supplemental payrolls showing the wage restitution.

- If the project is nearing completion and there is not enough time to wait for the checks to clear the bank, request that the contractor send certified checks, cashier’s checks, or money orders to the Labor Compliance office for disbursement to the employees.

- Request that the contractor make restitution within 10 working days or submit additional evidence to refute the findings.

- Notification guidelines:

- Notify by certified mail, return receipt requested, with a copy to the offending subcontractor, if applicable.

- Include copies of the completed Form CEM-2506, “Labor Compliance Wage Violation,” for each underpaid employee in the letter as attachments showing the wage underpayment calculations.

- Reference applicable sections of the labor code, contract, law, statute, or act.

20-6-1 Failure to Provide Records

If the contractor or subcontractor fails to make restitution or fails to submit records for review and consideration to resolve violations identified within 10 calendar days of the Audit Findings letter, send an Audit Findings Final Notice letter which can be found on the Headquarters Labor Compliance intranet website.

Depending on the audit findings, use the use the appropriate letter to coincide with the violations:

- If there are delinquent records, only check the first box.

- It there are underpayments only, check the second box and fill in the underpayment information and complete Form CEM-2506, “Labor Compliance Wage Violation.”

- If both violations are present, check both boxes, complete the underpayment section, and complete Form CEM-2506.

20-6-2 Receipt and Review of Supplemental Records

If the contractor sends records to resolve the violations, review newly submitted records and issue one of the following:

- If the submitted records do not resolve all identified violations, send an Audit Findings Review of Supplemental Records letter and include any violations that remain outstanding.

- If they fail to submit any further records, refer to Section 20-6-1, “Failure to Provide Records,” of this manual, send an Audit Findings Final Notice letter, and complete the process to prepare for a wage case.

- If the submitted records resolve all identified violations send an Audit Closed letter. The audit is now closed, and no further action is needed.

- If an audit did not result in the filing of a wage case, complete Form CEM-2508, “Contract Payroll Source Document Audit Summary,” and Form CEM-2509, “Checklist – Source Document Audit Summary,” and send copies to headquarters Labor Compliance unit showing all audit findings and resolutions.

20-6-3 When the Contractor Fails to Resolve Violations

If the Audit Findings Final Notice letter has been issued and the contractor fails to resolve the violations, take the following steps:

- Prepare a wage case for submission to headquarters.

- Complete Forms CEM-2506, CEM-2507, CEM-2508, and CEM-2509.

- Submit these forms with the wage case checklist and copies of all communications, records, and evidence applicable to your case.

- Contact the headquarters wage case administrator for guidance if you have questions.

20-6-4 When a Contractor Fails to Comply with an Audit

If the Labor Compliance officer is unable to perform the audit because of a contractor’s refusal to meet, the Labor Compliance officer must document all attempts to reach the subcontractor by mail, phone, discussions with prime contractor, or letters to employees. Do not write a zero-wage case without making every attempt to conduct the source document review. The Labor Compliance officer, however, can write a case showing a zero payment if no response is received.

The Labor Compliance officer may request that the Legal Division obtain an inspection warrant or writ from a court ordering the contractor to provide the information requested and permit the performance of duties as mandated by law. Submit this request through the Division of Construction Labor Compliance unit at the time of the occurrence. Include the facts and statements made by the contractor or others, and a list of witnesses, if applicable.

If interviews are not possible because of completion of that item of work, write to the employees directly to verify payment of specified prevailing wages. Include a self-addressed stamped envelope. If necessary, send copies of letters in Spanish and English.

20-6-5 When the Statute of Limitations Expires

If at any point during the audit the statute of limitations expires and Caltrans no longer has enforcement authority, complete the Notice of Audit Closed – Expired Statute letter.

20-6-6 Investigative Interviews

Investigative interviews can be completed with ongoing wage cases to obtain more detailed information from employees to confirm information already included in the wage case.

Field staff can also be interviewed to obtain confirmation of the validity of their daily reports, types of work performed on the job site, or information already included in the wage case.

Interviews should be scheduled in advance, and the interviewee should be made aware of the reason and scope of the interview when it is scheduled. Interviews must be conducted with at least one witness present and can be done in person, through conference call, or through a meeting software program such as Microsoft Teams.

The interviewer should not lead the interviewee to answer questions and should instead ask follow-up questions if further clarification is needed.

Caltrans’ contract number, attendee’s names, interviewee’s name, questions, and answers all need to be documented on the interview sheet and answers should be documented as accurately as possible.

Refer to the following link to the headquarters Labor Compliance intranet website for the template of the Wage Case Interview form and other templates discussed in this chapter.

https://construction.onramp.dot.ca.gov/letter-templates

20-6-7 Disputes

There may be multiple situations in which a contractor disputes the findings sent to them by the Labor Compliance officer. If there are disputes, the contractor is asked to submit additional documentation to substantiate their assertions.

If errors were made by the Labor Compliance officer, then the Labor Compliance officer can make corrections to Form CEM-2506 and send a revised Notification of Audit Findings.

If the dispute does not appear to be valid and the Labor Compliance officer and contractor do not agree, a final Notification of Audit Findings is sent indicating Caltrans’ position on the discrepancy.

20-6-8 Wage Cases

In the event violations cannot be resolved between the Labor Compliance officer and contractors, or when restitution is not received, it will be necessary to conduct a wage case. The case is prepared for submission to headquarters Labor Compliance for submission to DIR. It is imperative that every case is prepared and analyzed with the understanding that the case may not be resolved at the district level and the Labor Compliance officer may have to testify to their findings if the case goes to DIR and a hearing is held. The Labor Compliance officer must work concisely and carefully to make sure their findings are accurate and have merit.

The history of events is the foundation of any future wage case.

Documentation guidelines:

- Document the history of events chronologically.

- Document discussions, correspondence, good faith efforts to resolve disputes, and anything that could be related to a possible wage case with the contractor, employees, and resident engineers.

- The history of events should contain all contacts, such as phone conversations, letters sent or received, meetings, witness statements taken, or any other contacts.

20-7 Audit Completion and Close of Investigation

Once proof of restitution is received, the Labor Compliance officer:

- Sends an Audit Closed letter to the prime contractor and the affected subcontractor notifying them that the audit is complete.

- Updates Form CEM-2506 to reflect the check number and amounts to verify all restitution has been paid.

- Restitution proof should be either copies of the front and back of cashed restitution checks and corresponding check stubs, or the actual restitution checks. Restitution checks sent directly to the Labor Compliance officer are forwarded to the employees by USPS certified mail with a notice explaining the reason the check is being mailed. Figure 20‑A: “Compliance Audit Process,” shows the steps.

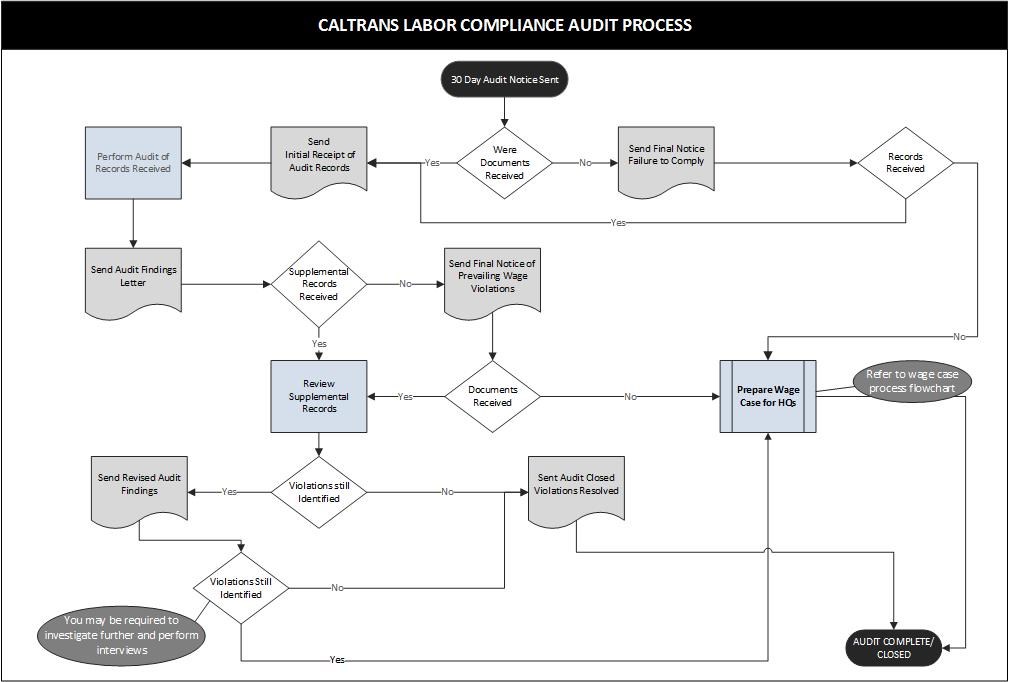

FIGURE 20‑A: COMPLIANCE AUDIT PROCESS

Labor Compliance Manual Chapters

Chapter 1 - History, Laws and Regulations Governing Prevailing Wage Requirements

Chapter 2 - Governing Agencies

Chapter 3 - Caltrans Labor Compliance Program and Related Requirements

Chapter 4A - Division of Construction-Administered Contracts

Chapter 4B - Other Division-Administered Contracts

Chapter 5 - State Wage Determination

Chapter 6 - Federal Wage Determinations

Chapter 7 - Labor Compliance File

Chapter 8 - Pre-Job Conference Requirements and Posters

Chapter 9 - Determining Prevailing Wage Covered Work

Chapter 10 - Classification of Labor and Required Rates of Pay

Chapter 11 - Apprentice Requirements

Chapter 12 - Federal Trainee Requirements

Chapter 13 - Weekly Certified Payroll Records

Chapter 15 - Payroll Review and Confirmation

Chapter 17 - Notification Process

Chapter 18 - Employee Interviews and Equal Employment Opportunity (EEO) Compliance

Chapter 19 - Complaints Process

Chapter 20 - Audits and Investigations Process

Chapter 21 - Wage Case Submittal

Chapter 22 - Restitution Collection