Chapter 5: State Wage Determination

- 5-1 Introduction

- 5-2 State Wage Rate Determination: Craft and Classification

- 5-3 Request for Special State Wage Rate Determinations

5-1 Introduction

The state prevailing wage rates are set by the California Department of Industrial Relations (DIR) and codified in Labor Code Sections 1773, and 1773.1. The published rates include prevailing wage rates that are based on the geographic location of the project and the type of work that is performed. The director of DIR determines general prevailing rate of per diem wages for a particular craft, classification, or type of worker at the state level, regional, such as Southern or Northern California, and by county.

5-1-1 Issue Date versus Effective Date

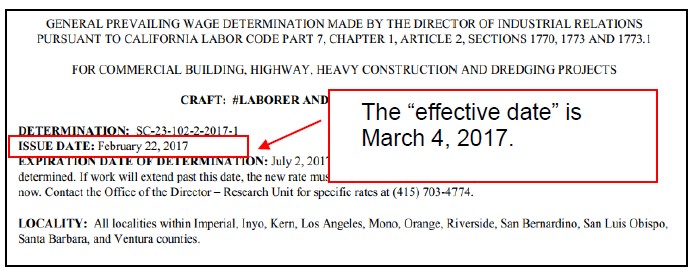

The general prevailing wage determinations are issued by the DIR biannually: February 22 and August 22. The date shown on the wage determination is considered the issue date and refers to the date that the rates are published and made available to the public. However, the effective date, which does not appear on the wage determination, is the actual date the rates go into effect, which is ten days after the issue date. The effective date, as shown in Figure 5-A, “Wage Determination Issue Date," represents the first date on which the wage rates from the most recent determination are applied to a project.

FIGURE 5‑A: WAGE DETERMINATION ISSUE DATE

5-1-2 Identifying the Proper Wage Determination Version

The “bid advertisement date” establishes the applicable general prevailing wage determination version for a project. If, for example, a solicitation is published March 15, 2017, the proper wage determination version is 2017-1, based on the February 22 issue date and a March 4 effective date. If the awarding body does not advertise or publish the public works project solicitation, then some other form of written memorialization, such as informal bid request letter or contract execution, may be used to establish the wage determination version. The prevailing wage determination in effect at the time of bid advertisement remains in effect for the duration of the project, subject to applicable predetermined increases.

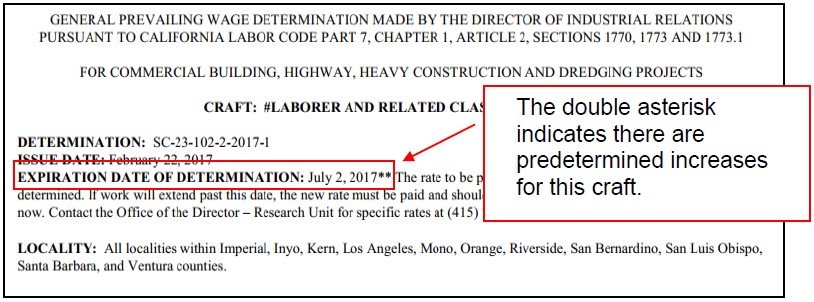

5-1-3 Rate Expiration and Predetermined Increases

The expiration date indicated for each craft is followed by either a single asterisk or double asterisk. Figure 5-B, “Expiration - Predetermined Increase,” shows an example of a double asterisk project.

Single asterisk indicates that the wage rate will remain constant and effective for the duration of the project.

Double asterisk indicates that the wage rate is effective until the expiration date, and the rate to be paid for work performed after that date has already been determined. If work will extend past the expiration date, the new rate must be paid and should be incorporated in this contract. (8 CCR 16204)

FIGURE 5‑B: EXPIRATION – PREDETERMINED INCREASE

5-2 State Wage Rate Determination: Craft and Classification

Any agency or entity awarding a public works contract is required under Labor Code Section 1773 to obtain from the DIR director the prevailing rates for all hours worked, including holiday and overtime. Labor Code Sections 1773.9 and 1773.4, also provide the awarding body a process for requesting a review of the methodology by which the director makes these determinations.

Each published determination includes craft and classifications in the geographical area where work is performed. The workers must be classified in the correct craft and paid according to the work they perform, regardless of union affiliation, other titles, or designations. To meet these standards, the contractor and persons or firms performing the work on the project must:

- Use classifications that are accurately descriptive of the work being performed. For example, if carpenters are used to place reinforcing steel, they should be shown as ironworkers and paid accordingly.

- Reclassify workers to conform to changes in duties in order to provide accurate and proper classification when duties or work tasks have been changed.

- Maintain an accurate record of the time spent in each work classification and show this time by means of separate entries in the payroll records and on the certified payroll.

A worker may be paid at the highest rate all day for all classifications in which they worked for any part of that day. If the higher wage rate is paid, separate entries in the payroll records are not required.

Most construction work is performed by recognized craft classifications; prevailing practice in the industry along with union jurisdiction over the workers can determine the proper classification. In case of a jurisdictional dispute between unions, where the scope of work is covered by more than one craft or classification, Caltrans permits the contractor to pay the lower wage rate until the dispute is resolved. Caltrans does not get involved in these disputes.

5-3 Request for Special State Wage Rate Determinations

The state general prevailing wage determinations issued by the DIR and Division of Labor Statistics and Research (DLSR), contains most crafts and classifications of workers needed to perform construction tasks required on Caltrans projects. The list can be found at:

https://www.dir.ca.gov/OPRL/DPreWageDetermination.htm

If there is a need to employ a unique labor classification not found in the state general prevailing wage determination, the district Labor Compliance officer (LCO) must obtain a special wage determination from the DIR. The request for a special prevailing wage determination must be made at least 45 days before the bid advertisement date.

For contracts already advertised, workers with unique classifications should be reclassified, if possible, to a comparable classification. The contractor, resident engineer and the LCO should jointly decide on a description and a wage rate for the type and scope of work to be performed. The contractor should be notified of the classification. If the contractor agrees to the designated classification and resulting increase in higher wage rate, if applicable, the contractor will be required to pay any back wages due and pay the higher wage rate from the determination date forward.

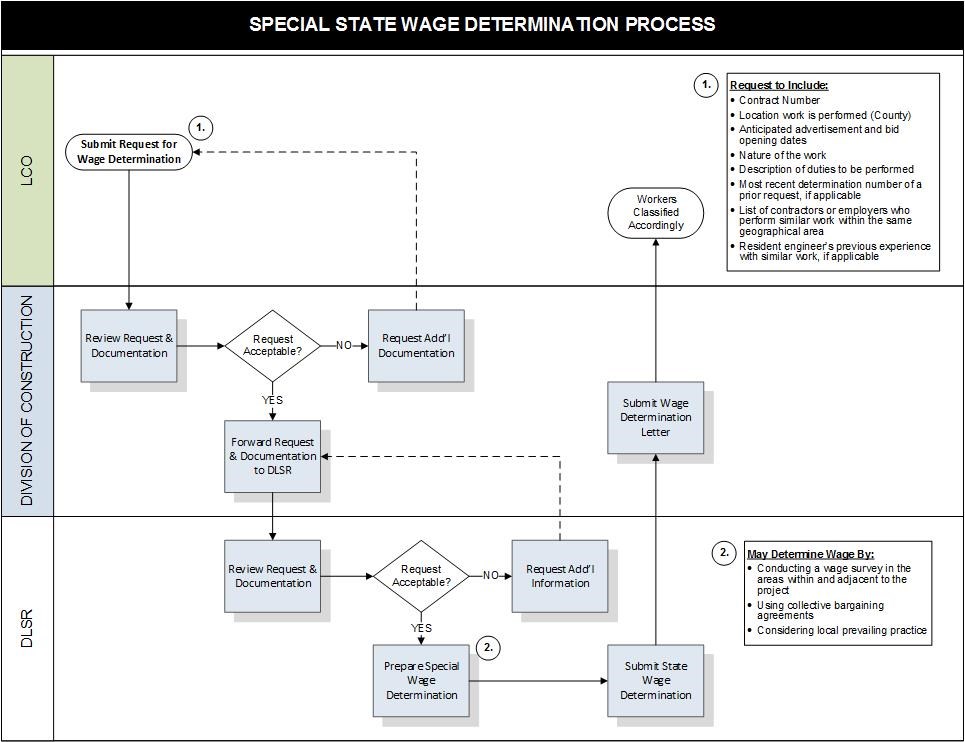

5-3-1 Special State Wage Determination Process

Figure 5-C, “Request for Special Wage Determination Process,” outlines the steps required to request a special state wage determination. The processing and submittal procedures can also be found in Section 8-105B, “Special Wage Determinations,” of the Construction Manual.

FIGURE 5‑C: REQUEST FOR SPECIAL WAGE DETERMINATION PROCESS

To request a special state wage determination, the LCO submits a written request to the Division of Construction headquarters labor compliance office. The following written information must be provided in the determination request:

- Contract number

- County where the work is performed

- Anticipated advertisement and bid opening dates, at least 45 days before the bid advertisement date

- Nature of the work

- Description of the duties to be performed

- The most recent determination number of a previous request, if applicable

- A list of contractors or employers, including complete addresses and telephone numbers, who perform work of a similar nature within the same geographical area

- The resident engineer’s previous experience with similar work, if applicable

The Division of Construction Labor Compliance unit reviews the documentation and will either forward the determination to the DLSR for a written determination or send it to:

Department of Industrial Relations

Office of the Director – Research Unit

PO Box 420603

San Francisco, CA 94142

Once DLSR has the necessary information to establish the prevailing wage rate for the requested classification, a special wage determination is prepared.

DLSR submits the special state wage determination to the Division of Construction Labor Compliance unit. The Division of Construction Labor Compliance unit sends the special state wage determination by cover memorandum to the LCO for handling.

Labor Compliance Manual Chapters

Chapter 1 - History, Laws and Regulations Governing Prevailing Wage Requirements

Chapter 2 - Governing Agencies

Chapter 3 - Caltrans Labor Compliance Program and Related Requirements

Chapter 4A - Division of Construction-Administered Contracts

Chapter 4B - Other Division-Administered Contracts

Chapter 5 - State Wage Determination

Chapter 6 - Federal Wage Determinations

Chapter 7 - Labor Compliance File

Chapter 8 - Pre-Job Conference Requirements and Posters

Chapter 9 - Determining Prevailing Wage Covered Work

Chapter 10 - Classification of Labor and Required Rates of Pay

Chapter 11 - Apprentice Requirements

Chapter 12 - Federal Trainee Requirements

Chapter 13 - Weekly Certified Payroll Records

Chapter 15 - Payroll Review and Confirmation

Chapter 17 - Notification Process

Chapter 18 - Employee Interviews and Equal Employment Opportunity (EEO) Compliance

Chapter 19 - Complaints Process

Chapter 20 - Audits and Investigations Process

Chapter 21 - Wage Case Submittal

Chapter 22 - Restitution Collection