Chapter 13: Weekly Certified Payroll Records

- 13-1 Introduction

- 13-2 Weekly Payroll, Form CEM-2502

- 13-3 Statement of Compliance, Form CEM-2503

- 13-4 Fringe Benefit Requirements

- 13-5 Apprentice Registration

13-1 Introduction

Weekly Certified Payroll Reports (CPRs) must be submitted to Labor Compliance at a time designated in accordance with the contract provisions.

- CPRs are due to Labor Compliance by the 15th of the month for the previous month’s work for construction projects.

- CPRs are due to the contract manager with the invoice for service contracts.

- CPR submittal requirements for emergency and Minor B contracts are listed in the contract provisions.

In addition to Form CEM-2502, “Certified Payroll Report,” the following related documents must be submitted:

- Statement of compliance

- Fringe benefit statement

- Apprentice forms including registration and DAS forms

- Other deduction authorizations

13-2 Weekly Payroll, Form CEM-2502

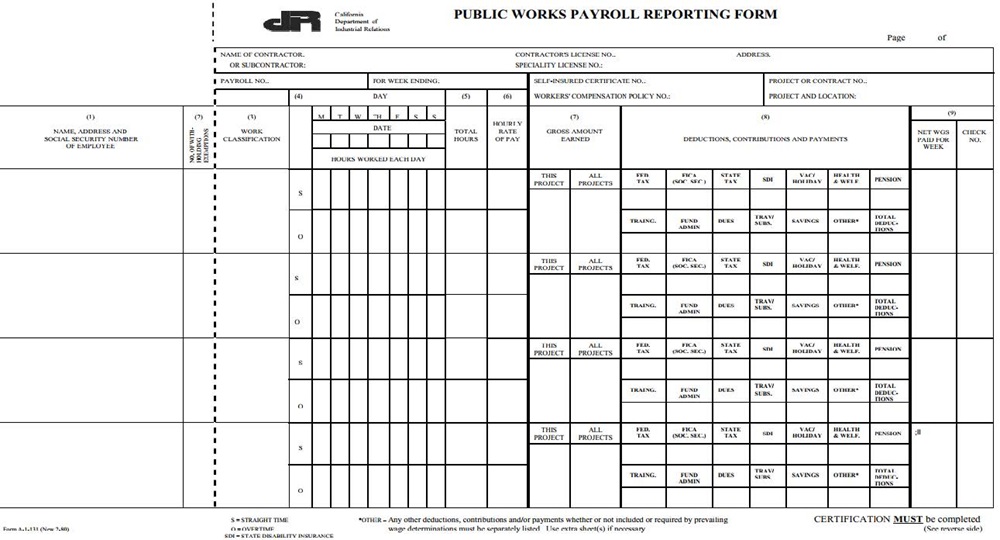

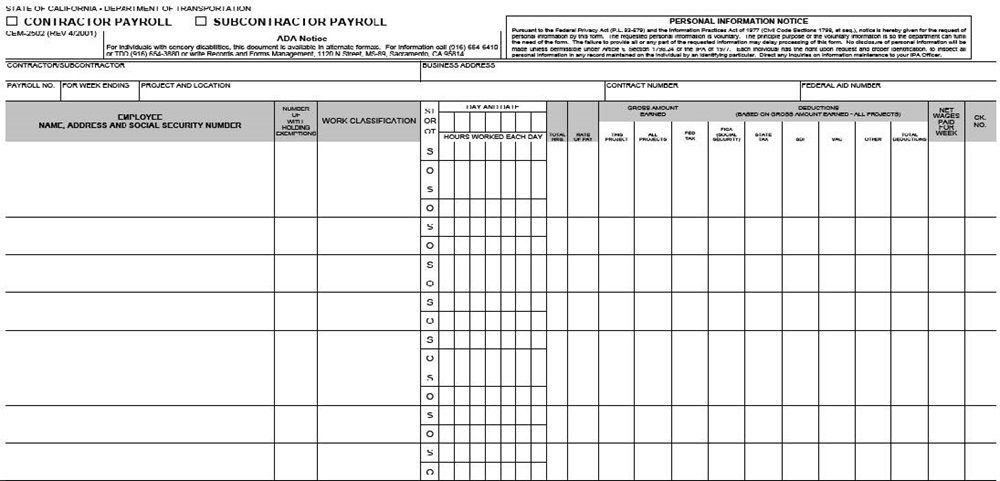

In accordance with California Labor Code Section 1776(c), contractors or subcontractors may use any form to submit payroll records, as long as they include all the information required by DIR and Labor Compliance. Figures 13-A, “DIR Certified Payroll Report,” and 13-B, “Caltrans DIR Certified Payroll Report,” are examples of forms used to report prevailing wage payroll information. Please be aware that manual forms will not be accepted for use in the web-based payroll system.

FIGURE 13‑A: DIR CERTIFIED PAYROLL REPORT

FIGURE 13‑B: CALTRANS DIR CERTIFIED PAYROLL REPORT

13-3 Statement of Compliance, Form CEM-2503

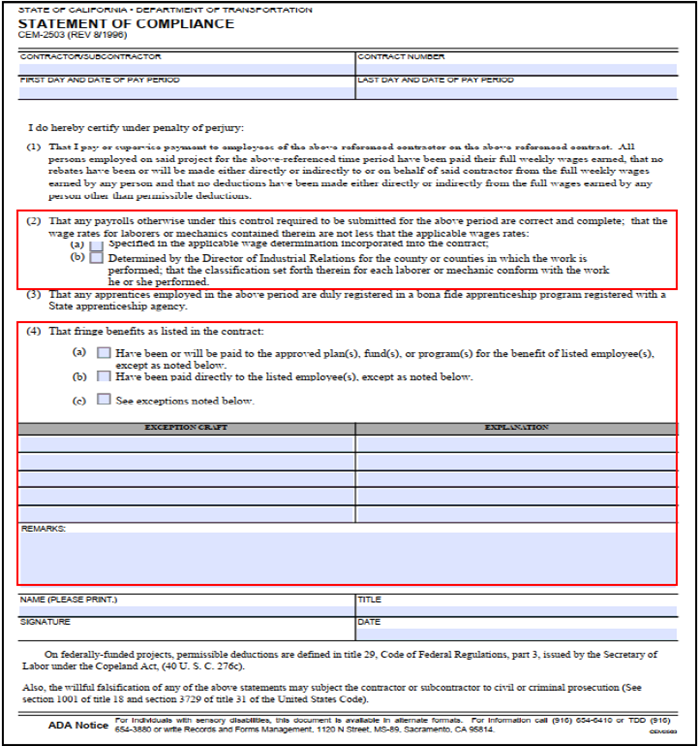

All payroll reports must include a completed and signed statement of compliance. A payroll is not considered to be certified unless accompanied by the statement of compliance. By signing the form, the contractor or subcontractor declares under penalty of perjury that the information submitted in the payroll reports is true and correct to the best of their knowledge.

13-3-1 Sections 2 and 4 of the Statement of Compliance

Figure 13-C, “CEM-2503, “Statement of Compliance,” notes where to indicate prevailing wage rates and payment of benefits.

- Contractors or subcontractors must complete Section 2 to indicate which wage determination is being used: (a) Specified in the applicable wage determination incorporated into the contract, Federal Davis-Bacon Act Determination or (b) determined by director of Industrial Relations, state determination. Contractors or subcontractors may check both boxes if they are using both determinations.

- Contractors or subcontractors must complete Section 4 to indicate how fringe benefits are paid: (a) to an approved plan, fund, or program; (b) directly to employee as part of a basic hourly rate. Benefits may also be paid as a combination of both or with noted exceptions.

- Use the exception craft/explanation/remarks areas to explain other deductions not explained on the weekly CPR and instances when fringe benefits are paid directly to employees, for example, cash instead of fringe benefits.

FIGURE 13‑C: CEM-2503, STATEMENT OF COMPLIANCE

13-4 Fringe Benefit Requirements

Under prevailing wage laws, contractors employing workers on public works projects can pay a certain portion of the “Total Hourly Rate” reflected on the applicable prevailing wage determination, to the worker either in cash, or as contributions to specified plans or entities as “Employer Payments.”

California Labor Code Section 1773.1(b) and (c), as defined at California Code of Regulations, Title 8, Section 16000 (8 CCR 16000), “Definitions,” sets forth the following requirements for payment of fringe benefits:

- Fringe Benefits include:

- Per diem wages: Basic rate, overtime, holiday pay and employer payments, such as vacation, pension, and medical insurance

- Fringe benefits do not include:

- Worker’s compensation, mandated costs

- Generally, sick leave or benefits required by law

- Payments identified as fringe benefits must either be:

- Irrevocable, in writing, and paid to a third-party trust if not paid to worker as part of basic hourly rate

- Actual costs to the employer reasonably anticipated in providing benefits to workers, such as vacation, holiday, or paid time off. To get credit for these benefits the contractor or subcontractor may be required to submit documents confirming the benefits are:

- Pursuant to an enforceable commitment.

- Carried out by a financially responsible plan or program.

- Communicated in writing to the workers affected.

- Cannot decrease basic hourly rate or total rate

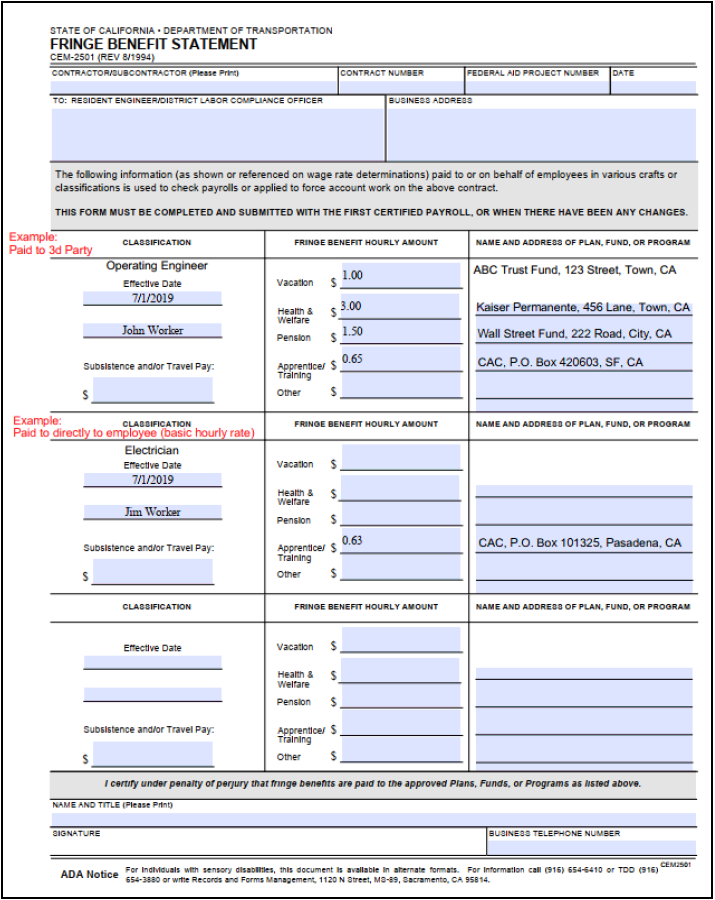

Figure 13-D, “CEM-2501, Fringe Benefit Statement,” shows the form that is one of the required labor compliance documents and shows to indicate employer payments on behalf of the employee. Fringe benefits and basic hourly rate must equal the prevailing wage total rate.

If benefits are paid to a plan, fund, or program, Form 2501 should show where the funds are being paid to receive credit toward to the total hourly rate required.

13-4-1 Fringe Benefit Statement, Form CEM-2501

All entries on Form CEM-2501, “Fringe Benefit Statement,” must be completed thoroughly and accurately. Figure 13-D, “CEM 2501, Fringe Benefit Statement,” provides an example of entries paid to a third party, such as a plan, fund, or program, and an example of cash paid instead of fringe benefits. Contractors who pay all worker fringe benefits in cash as part of basic hourly rate, should still complete and submit Form CEM-2501.

FIGURE 13‑D: CEM-2501, FRINGE BENEFIT STATEMENT

13-4-2 Fringe Benefit Annualization

Annualization is a principle adopted by the U.S. Department of Labor to give credit for contributions made to fringe benefit plans. Credits are based on effective annual rate of contributions for all hours worked during the year by an employee. Figure 13-E, “Fringe Benefit Annualization Formula,” shows how annualized benefits are calculated.

California Labor Code Section 1773.1(e) requires that the credit for employer payments be calculated on an annualized basis when the employer seeks credit for payments that are higher for public works projects than for private construction performed by the same employer.

FIGURE 13-E: FRINGE BENEFIT ANNUALIZATION FORMULA

| FRINGE BENEFIT ANNUALIZATION FORMULA |

|

The formula is as follows: 2,080 hours used for annualization (40 hours X 52 weeks) Total Annual Cost / 2,080 Hours = Fringe Benefit Hourly Credit (*or (monthly cost x 12) / 2,080 Hours) Example: Laborer Basic Hourly Rate: $27.89 Fringe Benefits: $19.28 Total Hourly Rate: $47.17 Medical Contribution by Contractor: $200/month ($200 x 12 months) divided by 2,080 hours = $1.15 per hour credit $19.28 required benefits minus $1.15 credit = $18.13 Basic Hourly Rate: $27.89 Medical Insurance Credit: $1.15 Additional Cash Due Employee: $18.13 Total Hourly Rate Due: $47.17 ($27.89 + $19.28) |

13-4-2(a) Exceptions:

- The employer has an enforceable obligation to make the higher

rate of payments on future private construction performed by the - The higher rate of payments is required by a project labor

- The payments are made to the California Apprenticeship Council pursuant to California Labor Code Section 1777.5.

- The director determines that annualization would not serve the

purposes of this chapter.

13-5 Apprentice Registration

When apprentices are employed and reported, the contractor or subcontractor is required to submit apprentice certificates confirming enrollment in a state or federally approved program, or both, for the first payroll period in which the apprentice appears.

The Labor Compliance officer is responsible for verification of apprentice registration status and collection of apprentice certificates. Registration must be consistent with craft shown on the CPR.

13-5-1 State Apprentice Certification

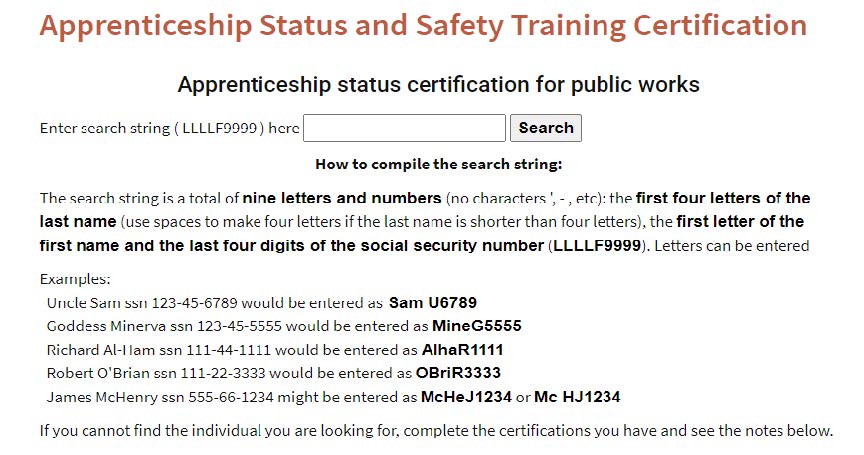

DIR has a public website that displays apprentice certificates using information provided on the CPR. Figure 13-F, “Apprenticeship Status Certification,” shows an example.

https://www.dir.ca.gov/das/appcertpw/AppCertSearch.asp

FIGURE 13‑F: APPRENTICESHIP STATUS CERTIFICATION

13-5-2 Federal Apprentice Certification

For projects that include federal funding, federal program apprentice registration and the state certificate will be required.

There is no public database to obtain federal apprenticeship certificates. The contractor or subcontractor must submit the appropriate federal certificate for verification of enrollment in a federally approved program to obtain apprentice credit and pay the apprentice rate of pay.

Federal certificates expire 90 days after issuance. The contractor or subcontractor will be required to continue to submit apprentice certificates throughout apprentice employment to obtain credit and pay the apprentice rate of pay.

Labor Compliance Manual Chapters

Chapter 1 - History, Laws and Regulations Governing Prevailing Wage Requirements

Chapter 2 - Governing Agencies

Chapter 3 - Caltrans Labor Compliance Program and Related Requirements

Chapter 4A - Division of Construction-Administered Contracts

Chapter 4B - Other Division-Administered Contracts

Chapter 5 - State Wage Determination

Chapter 6 - Federal Wage Determinations

Chapter 7 - Labor Compliance File

Chapter 8 - Pre-Job Conference Requirements and Posters

Chapter 9 - Determining Prevailing Wage Covered Work

Chapter 10 - Classification of Labor and Required Rates of Pay

Chapter 11 - Apprentice Requirements

Chapter 12 - Federal Trainee Requirements

Chapter 13 - Weekly Certified Payroll Records

Chapter 15 - Payroll Review and Confirmation

Chapter 17 - Notification Process

Chapter 18 - Employee Interviews and Equal Employment Opportunity (EEO) Compliance

Chapter 19 - Complaints Process

Chapter 20 - Audits and Investigations Process

Chapter 21 - Wage Case Submittal

Chapter 22 - Restitution Collection