Chapter 22: Restitution Collection

22-1 Introduction

Restitution is a supplemental payment made by a contractor or subcontractor as a result of an underpayment to an employee or an organization, such as the California Apprenticeship Council (CAC) or a labor union. It is paid to meet the prevailing wage requirement. Labor Compliance officers who review certified payroll and fringe benefit statements will identify these underpayments, but they may also be identified as a result of a complaint, payroll audit, or wage case. In each of these scenarios, Labor Compliance officers will notify the prime contractor and subcontractors to either request:

- Restitution checks to be submitted to the district for distribution to the employees.

- Proof of payment to the employees, usually in the form of check stubs and copies of cancelled checks, front and back, and bank statements.

- Proof of restitution to the CAC in the form of an invoice to the CAC and the cashed check, or use of the CAC website to verify payments at: CAC - Public works Training Fund Search

- Proof of restitution to a labor union in the form of a copy of the cashed check, electronic funds transfer or automated clearing house payment record or a business bank statement, and corresponding union report.

During the restitution confirmation process, districts will monitor and identify contractor patterns of underpayment, which could be the result of an incorrect job classification or a change in pay rate. Factors considered include whether the underpayment occurred during the first or second payroll, and a contractor’s willingness to pay the restitution. If the underpayments are more systemic, or if a contractor or subcontractor is uncooperative, districts will proceed with a district-level wage case similar to wage cases processed at headquarters.

22-2 Restitution Confirmation

The restitution confirmation process involves the verification of all documents provided as proof of restitution against each other. For example, the record of underpayment is verified against the submitted check stub. The check stub is verified against the cancelled check and the canceled check is validated to make sure it was signed by the employee it is paid to.

Once an underpayment has been identified, the prime contractor or subcontractor is notified, and proof of restitution is requested. This proof is normally in the form of:

- Copies of cancelled checks, front and back

- Check stubs from the original payroll on which there is an underpayment

- New check stubs to go with the restitution check

- If employee payments are in the form of direct deposit, proof of these payments will look different for every company, but are normally:

- Itemized wage statements, such as check stubs accompanied by a check, direct deposit confirmation or bank statement, earning statements, payroll vouchers

- Copies of the direct deposit enrollment forms for the employee being paid

- Business banking statements showing outgoing payment to the employee

22-2-1 Restitution Confirmation Process Overview

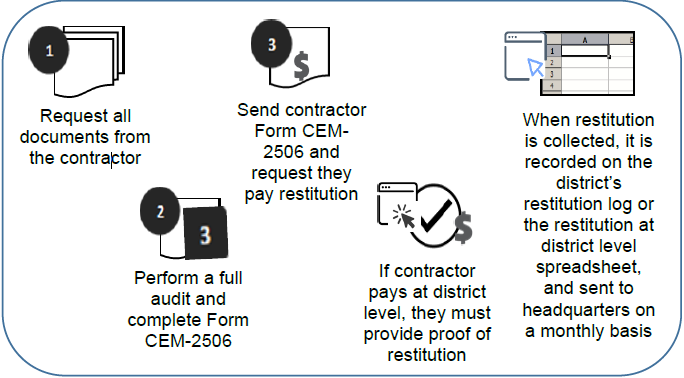

Notify the contractor of underpayment and required restitution, include a request they pay restitution to resolve underpayment violation.

NOTE: In some cases, an identified underpayment is noted in the monthly letter only.

If the contractor pays the restitution at the district level, proof of restitution must be provided in source records, but the issue does not need to be escalated to Headquarters.

If there are unresolved restitution requirements or if there is a complaint, perform a full audit and complete the CEM-2506, “Labor Compliance Wage Violation.”

When restitution is collected, the Labor Compliance officer will record it on a Smartsheet form available at the following Labor Compliance intranet page:

https://construction.onramp.dot.ca.gov/labor-compliance/labor-compliance-reports

FIGURE 22‑A: RESTITUTION PROCESS OVERVIEW

22-3 Restitution Collection Close-out

As part of the restitution collection close-out process, district staff will be required to go to the Labor Compliance intranet website to complete a form that will populate a “Smartsheet system” in real-time.

22-3-1 Smartsheet System

In accordance with Labor Compliance Policy Bulletin 22-1, “Labor Compliance Restitution at District Level Reporting,” Labor Compliance officers who monitor and receive restitution for underpayment violations will have access to the restitution at district level form in the Smartsheet system. Submitting this form will assist in monitoring and recording restitution in real-time and provide more accurate data for semi-annual and annual reporting.

Forms can be completed on a one-for-one basis for each contract or project for which restitution is requested or when restitution payments are received from the contractor. Likewise, restitution payments can be recorded in bulk on the spreadsheet.

Labor Compliance officers will only have review and edit access to the contract numbers they enter in the Smartsheet system. Labor Compliance managers will have limited access to edit the contracts in the system that coincide with the districts they oversee and manage. They should review and finalize the restitution at district level data by the 15th of each month for the previous month’s collected restitution.

Labor Compliance Manual Chapters

Chapter 1 - History, Laws and Regulations Governing Prevailing Wage Requirements

Chapter 2 - Governing Agencies

Chapter 3 - Caltrans Labor Compliance Program and Related Requirements

Chapter 4A - Division of Construction-Administered Contracts

Chapter 4B - Other Division-Administered Contracts

Chapter 5 - State Wage Determination

Chapter 6 - Federal Wage Determinations

Chapter 7 - Labor Compliance File

Chapter 8 - Pre-Job Conference Requirements and Posters

Chapter 9 - Determining Prevailing Wage Covered Work

Chapter 10 - Classification of Labor and Required Rates of Pay

Chapter 11 - Apprentice Requirements

Chapter 12 - Federal Trainee Requirements

Chapter 13 - Weekly Certified Payroll Records

Chapter 15 - Payroll Review and Confirmation

Chapter 17 - Notification Process

Chapter 18 - Employee Interviews and Equal Employment Opportunity (EEO) Compliance

Chapter 19 - Complaints Process

Chapter 20 - Audits and Investigations Process

Chapter 21 - Wage Case Submittal

Chapter 22 - Restitution Collection