Chapter 23: Public Records Act Request

- 23-1 Introduction

- 23-2 Public Records Act Request Coordinator

- 23-3 Response Time

- 23-4 Reproduction Costs

- 23-5 Certified Payroll Requests and Redaction Requirements

- 23-6 Requests Received from GovQA

- 23-7 Requests from Mail, Email or Fax

23-1 Introduction

Labor Compliance officers are responsible for managing California Public Records Act (CPRA) requests for certified payroll reports for the Division of Construction. Contract managers are responsible for CPRA requests received for service contracts.

Figure 23-A, “Public Records” shows that public records include any written communication containing information pertaining to the conduct of Caltrans’ business that is prepared, owned, used, or retained by Caltrans according to California Government Code Section 6252 (e). Figure 23-B, “Records Exempt from Disclosure,” lists items that are not part of the public domain.

FIGURE 23‑A: PUBLIC RECORDS

| PUBLIC RECORDS |

|

The following are considered public records:

|

FIGURE 23‑B: RECORDS EXEMPT FROM DISCLOSURE

| EXEMPT RECORDS |

|

The following documents are exempt from disclosure:

|

Certified payroll records (CPR) refer to weekly payroll reports prepared by the contractor. This includes the contractor’s weekly work force for each day of a workweek, together with the schedule of direct wage payments, fringe benefit payments, and all other withholdings authorized by law.

Statement of compliance is part of the CPR and the certification, and it is automatically sent as an additional page. Fringe benefit statements are also part of CPR. Failure to provide the fringe benefit statements may make the requestor think there is an underpayment when there is not.

There are two ways Caltrans responds to Public Records Act requests and disbursement of records based on how the request is received. If received by mail, email, or fax, the response is manual. If received in digital public records request system, GovQA, the response is sent electronically, except for payments. Both response types require receipt of payment by check before the records can be released.

Caltrans has developed policies and procedures that are consistent with regulations governing the release of public records:

- In accordance with California Labor Code Section 1776 (a), (b3), (e) and (f), Caltrans has the legal obligation to supply a certified copy of an employee’s payroll record to any party who requests the record.

- California Labor Code Section 1776 (j) also authorizes that Caltrans be paid a reasonable fee to defray the cost of providing the record.

- The California Public Records Act (CPRA), California Government Code Sections 6250–6276.48 contains the legal requirement to provide a written response to requests within 10 calendar days following receipt of a request.

Headquarters Division of Construction Labor Compliance unit is available to answer questions about written determinations, document requests, and the legal ramifications of providing records. The Division of Construction Labor Compliance unit may forward requests to the Legal Division for advice regarding privacy and legal rights based on the facts and circumstances presented.

23-2 Public Records Act Request Coordinator

Labor Compliance officers and contract managers can respond directly to payroll requests. However, Labor Compliance officers and contract managers are to send the request to the district Public Records Act Coordinator if the CPRA is specifically cited in the written request for records. District Public Records Act Coordinators can be found online in the FAQ section of the Public Records Center.

23-3 Response Time

CPRA California Government Code Section 6253 (c) contains the legal requirement to provide a written response to requests within 10 calendar days following the receipt of the request.

Response to Written Request

Caltrans receives written requests for copies of certified payrolls by way of GovQA or mail, email, or fax. Written requests must include all of the following information:

- A contract number or description.

- The job location, and if more than one job location, the name of the contractor performing the work and the regular business address, if known.

- Any request for records of more than one contractor or subcontractor must clearly define the responsibilities regarding each individual contractor, regardless if all requests pertain to the same public works project.

If any of the information is missing, the assigned staff should request the missing information by telephone. Make sure a reasonable effort has been made to obtain the missing information before returning a request to the requestor.

As previously stated, the assigned staff must acknowledge all written requests within 10 calendar days. An acknowledgement is automatically generated for requests submitted through the GovQA system. For requests received by mail, email or fax, staff must generate an acknowledgment letter. An acknowledgement letter template can be found on the online Caltrans template library (ZIP).

23-4 Reproduction Costs

California Labor Code Section 1776 (j) and 8 CCR 16402, “Cost,” authorize Caltrans to be paid a reasonable fee for the cost of reproducing a record.

Pursuant to 8 CCR 16402, the costs are:

- $1 for the face sheet of each weekly-certified payroll document

- $0.25 for each subsequent page

For example, if records for three successive weeks are requested from a given contractor’s payroll documents, $1 is charged for the face sheet of each of the three separate weekly reports and $0.25 for each of the following subsequent pages contained in each of those weekly reports.

23-5 Certified Payroll Requests and Redaction Requirements

Requests for certified payrolls may come from multiple requestors including, but not limited to: members of the public, competing companies, joint labor-management committees trust funds, and the Joint Enforcement Strike Force. There are specific redaction requirements for each of these requestor groups pursuant to the requirements in California Labor Code Section 1776 (e)(f) as outlined in the following sections. Additional information can be found in the Redaction Guidelines (PDF).

Note: Requests made by joint labor-management committees, Taft-Hartley trust fund or Joint Enforcement Strikeforce must specify their request is made pursuant to the appropriate California Labor Code section. If the request does not indicate the request is being made pursuant to one of these, staff should redact according to public requirements.

23-5-1 Joint Labor-Management Committees

Any copies of records made available for inspection by, or furnished to, a joint labor-management committee established pursuant to the federal Labor Management Cooperation Act of 1978 (United States Code, Title 29, Section 175a (29 USC 175a), “Assistance to Plant, area, and industrywide labor management committees,” and California Labor Code Section 1776 (e), must be marked or obliterated to prevent only the disclosure of the Social Security number, as shown.

23-5-2 The Public

Any documents furnished to the public pursuant to California Labor Code Section 1776 (e) must be marked or obliterated to prevent the disclosure of name, address, and Social Security number as shown.

Note: The name and address of the contractor awarded the contract or the subcontractor performing the contract does not need to be obliterated.

23-5-3 Taft-Hartley Trust Funds

Any copies of records made available for inspection by, or furnished to, a multi-employer Taft-Hartley trust fund, 29 USC 186(c)(5), “Restrictions on Financial Transactions,” that requests the records for the purpose of allocating contributions to participants, must be marked or obliterated to prevent only the full disclosure of the Social Security number, but provide the last 4 digits, as shown.

23-5-4 Joint Enforcement Strike Force

California Labor Code Section 1776 (f) requires that agencies included in the Joint Enforcement Strike Force on the Underground Economy established pursuant to California Unemployment Insurance Code Section 329 and other law enforcement agencies investigating violations of law must, upon request, be provided nonredacted copies of certified payroll records. Any copies of records or certified payroll made available for inspection and furnished upon request to the public by an agency included in the Joint Enforcement Strike Force on the Underground Economy or to a law enforcement agency investigating a violation of law shall be marked or redacted to prevent disclosure of an individual’s name, address, and Social Security number.

23-6 Requests Received from GovQA

Individuals or entities seeking public records are encouraged to use GovQA, which is an online portal used to:

- Submit a request to Caltrans

- Track the status of the request

- Provide a communication link between Caltrans and the requestor

- Send out the requested documents electronically

Note: Payment for the public record received must be made by check and not through GovQA.

Both Caltrans staff and requestors must create a GovQA account to use the site. Caltrans Labor Compliance staff should contact Labor Compliance headquarters to set up account access, while other Caltrans staff should contact their public information officer or External Affairs unit. Requestors may create their accounts by visiting the Caltrans website and scroll down on the main page to “Online Services/Permits” and select “Request Public Records” to access the site.

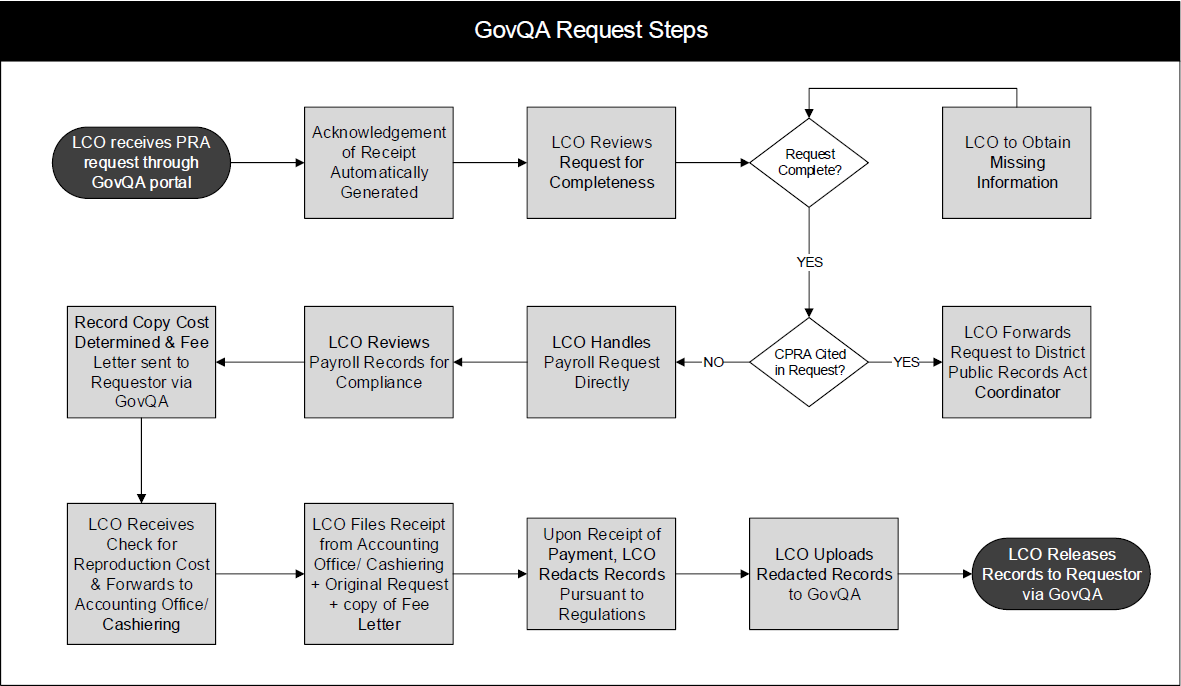

23-6-1 GovQA Request Steps

Many of the steps to respond to a CPRA request received in GovQA are electronic. The following steps outline the process.

- The Labor Compliance officer, or contract manager, receives a PRA request through GovQA portal. An acknowledgement of receipt is automatically generated.

- The Labor Compliance officer, or contract manager, reviews the request for completeness. The request must include:

- A contract number or description.

- The job location and if more than one job location, the name of the contractor performing the work and the regular address if known.

- Any request for records of more than one contractor or subcontractor must clearly define the responsibilities regarding each contractor, even if all requests pertain to the same public works project.

If any of the required information listed is missing, the Labor Compliance officer or contract manager should request the missing information by telephone and must make sure a reasonable effort is taken to obtain the missing information before returning the request to the requestor.

Labor Compliance officers or contract managers respond to payroll record requests or forward requests to the district public records act coordinator if the CPRA is specifically cited in the written request for records.

District public records act coordinators can be found online in the FAQ section of the Public Records Center.

The Labor Compliance officer or contract manager must review requests for certified payroll records before furnishing copies to a requesting party. The payroll records are also reviewed for compliance, and any corrective action must be initiated before responding to the requesting party.

The cost to reproduce the record is determined pursuant to regulations and a fee letter is sent to the requestor through GovQA. A customizable template fee letter is available in GovQA.

Upon receipt of a check for reproduction costs, staff will forward it through interoffice mail to the local accounting office or cashiering.

Checks are made payable to the California Department of Transportation.

File the receipt received from the accounting office or cashiering along with the original request and a copy of the fee letter.

Upon receipt of payment, the Labor Compliance officer or contract manager redacts the records pursuant to regulations.

The Labor Compliance officer or contract manager uploads the redacted records and releases them to the requestors through GovQA. A customizable “release of record” letter is available in GovQA.

The steps to handling a PRA request are summarized in Figure 23-C, “Public Records Act (PRA) Request Process – GovQA.”

FIGURE 23‑C: PUBLIC RECORDS ACT (PRA) REQUEST PROCESS - GovQA

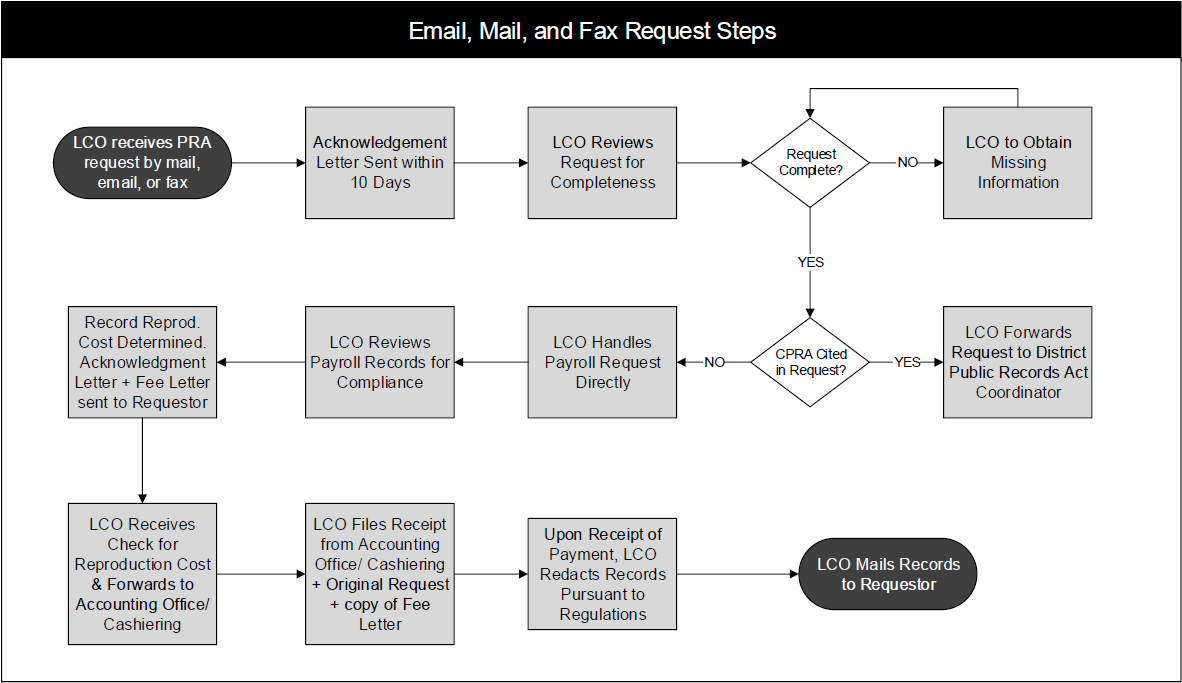

23-7 Requests from Mail, Email or Fax

Requests for copies of certified payroll records can also be submitted by mail, email, or fax. Following are the steps to remit the requested documents to the requestor.

23-7-1 Mail, Email or Fax Request Steps

The Labor Compliance officer or contract manager receives a written PRA request by mail, email or fax and an acknowledgement letter is sent within 10 business days pursuant to regulations. An acknowledgement letter template can be found on the online Caltrans template library.

Construction Labor Compliance Letter Templates (ZIP)

The Labor Compliance officer or contract manager reviews the request. The request must include all of the following:

- A contract number or description.

- The job location and if more than one job location, the name of the contractor performing the work and the regular address if known.

- Any request for records of more than one contractor or subcontractor must clearly define the responsibilities regarding each individual contractor, even if all requests pertain to the same public works project.

If any of the required information listed is missing, staff should request the missing information by telephone and must make sure a reasonable effort is taken to obtain the missing information before returning the request to the requestor.

The Labor Compliance officer or contract manager either handles the payroll request directly or forwards to the district public records act coordinator if the CPRA is specifically cited in the written request for records.

District public records act coordinators can be found online under the FAQ section of the Public Records Center.

The Labor Compliance officer or contract manager must review requests for certified payroll records before furnishing copies to a requesting party. The payroll records are also reviewed for compliance, and any corrective action must be initiated before responding to the requesting party.

The cost to reproduce the record is determined pursuant to regulations.

An acknowledgement letter and fee letter are generated manually. Letter templates can be found on the online Caltrans template library (ZIP).

Upon receipt of the check for reproduction costs, staff must forward it through interoffice mail to local accounting office or cashiering.

Checks are made payable to the California Department of Transportation.

File the receipt received from the accounting office or cashiering along with the original request and a copy of the fee letter.

Upon receipt of payment, the Labor Compliance officer or contract manager redacts the records pursuant to regulations.

The Labor Compliance officer or contract manager mails the payroll records to the requestor. A release of record letter template can be found on the Labor Compliance template library (ZIP).

FIGURE 23‑D: PUBLIC RECORDS ACT (PRA) REQUEST PROCESS

Labor Compliance Manual Chapters

Chapter 1 - History, Laws and Regulations Governing Prevailing Wage Requirements

Chapter 2 - Governing Agencies

Chapter 3 - Caltrans Labor Compliance Program and Related Requirements

Chapter 4A - Division of Construction-Administered Contracts

Chapter 4B - Other Division-Administered Contracts

Chapter 5 - State Wage Determination

Chapter 6 - Federal Wage Determinations

Chapter 7 - Labor Compliance File

Chapter 8 - Pre-Job Conference Requirements and Posters

Chapter 9 - Determining Prevailing Wage Covered Work

Chapter 10 - Classification of Labor and Required Rates of Pay

Chapter 11 - Apprentice Requirements

Chapter 12 - Federal Trainee Requirements

Chapter 13 - Weekly Certified Payroll Records

Chapter 15 - Payroll Review and Confirmation

Chapter 17 - Notification Process

Chapter 18 - Employee Interviews and Equal Employment Opportunity (EEO) Compliance

Chapter 19 - Complaints Process

Chapter 20 - Audits and Investigations Process

Chapter 21 - Wage Case Submittal

Chapter 22 - Restitution Collection