Chapter 11: Apprentice Requirements

- 11-1 Introduction

- 11-2 Exemptions

- 11-3 Caltrans Apprentice Responsibilities

- 11-4 Apprenticeable Craft or Trade

- 11-5 Journeyperson-on-Duty Requirement

- 11-6 Apprentice Registration Requirements

- 11-7 Forms DAS-140 and DAS-142

- 11-8 Training Fund

- 11-9 Ratio Requirements

11-1 Introduction

California apprentice requirements are administered by the California Department of Industrial Relations, Division of Labor Standards Enforcement (DLSE) that has joint responsibility with the Division of Apprenticeship Standards (DAS) to enforce the provisions of Section 1777.5 of the California Labor Code. Contractors who knowingly violate any of the apprentice requirements are subject to monetary penalties under Labor Code Section 1777.7, and they risk being denied the right to bid on or be awarded a contract for public works, or perform work as a subcontractor on a public works project for as long as three years.

Labor Code Section 1777.5 requires that contractors working on public works projects comply with the following apprentice requirements:

- Employ apprentices for all apprenticeable crafts on project contracts valued at $30,000 or more, regardless of the subcontract value. The limited exemptions to this requirement are identified in Section 11-2, Exemptions,” of this manual.

- Provide proof of apprentice registration in an approved apprenticeship program for the classification in which they are working.

- Pay training fund contribution as a fringe benefit the amount identified in wage determination to an approved training program or to the California Apprenticeship Council (CAC).

- Comply with minimum ratio requirement of 1 apprentice hour for every 5 journeyperson hours on apprenticeable crafts.

- Submit Form DAS-140, “Notification of Contract Award,” to the applicable apprenticeship program before starting work and Form DAS-142, “Request for Dispatch of an Apprentice.”

- For federally funded contracts, apprentices must be appropriately registered in a federally approved apprentice program in addition to a state-approved apprentice program.

11-2 Exemptions

The following are examples in which a contractor on a public works project is considered exempt from the apprentice requirements under Labor Code Section 1777.5:

- If the general contractor’s contract is less than $30,000.

- This amount represents the aggregate value of the entire contract and does not apply to subcontractors whose contract with the prime is less than $30,000.

- Contractor must still pay the training fund fee and submit proof of the monthly payments.

- A particular craft or trade is not apprenticeable. Refer to Section 11-4, “Apprenticeable Craft or Trade,” of this manual for information on how to identify if a trade or craft is apprenticeable.

- When a contractor holds a sole proprietor license and personally performs all the work from start to finish, unassisted.

- Contractor must still pay the training fund fee and submit proof of the monthly payments.

- When the project has a private funding source and does not fall within the definition of a public works project under Labor Code Section 1720.

11-3 Caltrans Apprentice Responsibilities

Take the following steps if apprentices are employed on a project:

- Verify that apprentices are registered by collecting required state, and federal apprentice certificates for all apprentices in apprenticeable crafts.

- Verify that training fund contributions are paid to an approved apprenticeship program or the CAC.

- Monitor and enforce maximum journeyperson-to-apprentice ratio requirements

- If contractor or subcontractor payrolls indicate the apprentice to journeyperson ratio is beyond maximum allowable requirements of Labor Code 1777.5, request a copy of the Apprentice Program Standards and review the maximum ratio requirement, to determine if there has been a violation.

- Under Labor Code Section 1777.5(h), violations are measured by determining the total hours worked by the apprentices and journeyperson at the end of the contract, not on a daily basis.

- For additional information, see Section 3.3.2.3, “Maximum Ratio Violations,” of the DIR Public Works Manual.

- If contractor or subcontractor payrolls indicate the apprentice to journeyperson ratio is beyond maximum allowable requirements of Labor Code 1777.5, request a copy of the Apprentice Program Standards and review the maximum ratio requirement, to determine if there has been a violation.

- Monitor and enforce journeyperson-on-duty requirements

- If the contractor employs apprentices under the regulations of CAC, verify that a journeyperson in the same classification is present on the worksite when an apprentice is employed.

- This is a mandatory daily obligation that applies when a worker is paid as an apprentice, not a ratio requirement in which compliance is determined at the end of the contract.

- For additional information, see Section 3.3.2.4, “Journeyman on Duty Violations,” of the DIR Public Works Manual.

- If the contractor employs apprentices under the regulations of CAC, verify that a journeyperson in the same classification is present on the worksite when an apprentice is employed.

|

In the event of a violation of the apprentice requirements, follow the “withhold payment” in accordance with contract provisions and follow the “notification procedures” as described in Chapter 17 of this manual |

- Confirm that restitution payments are made for apprentice underpayments, as applicable

- If a contractor or subcontractor does not pay required restitution, complete a wage case and submit to the headquarters Labor Compliance unit.

11-4 Apprenticeable Craft or Trade

Apprenticeable crafts are those determined as an apprenticeable occupation in accordance with rules and regulations of the California Apprenticeship Council

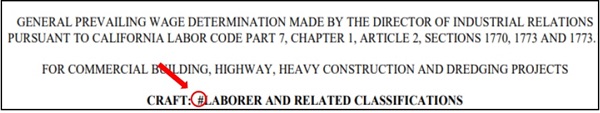

Apprenticeable crafts are identified by a hashtag symbol, or pound sign, preceding the craft or trade name on the California DIR wage determination, as illustrated in Figure 11-A: “Example 1.”

- Single hashtag symbol or pound sign: An apprenticeable craft that requires that training contributions be paid to an approved training program.

FIGURE 11‑A: EXAMPLE 1

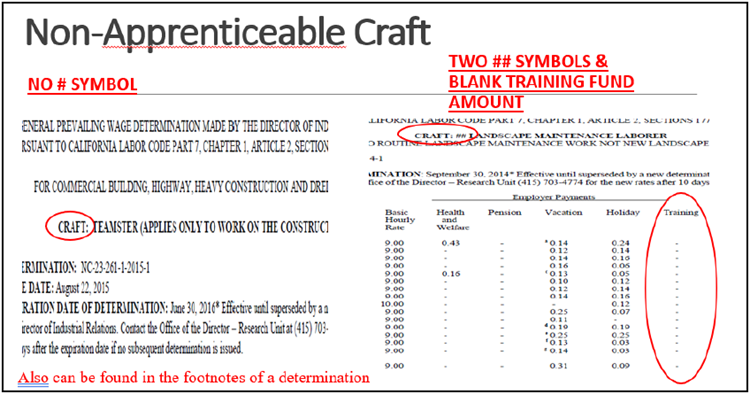

- No hashtag symbol, pound sign, or a double pound sign: Not an apprenticeable craft or trade. Training contributions can be paid to the employee or an approved training program, as shown in Figure 11-B, “Example 2.”

FIGURE 11‑B: EXAMPLE 2

11-5 Journeyperson-on-Duty Requirement

Labor Code Section 1777.5(c)(2) allows a contractor to elect to have its apprentices employed and trained in accordance with the rules and regulations of the CAC to satisfy its statutory obligation to employ apprentices. Alternatively, Labor Code Section 1777.5(c)(1) allows the contractor to have its apprentices employed and trained in accordance with the standards of a DAS-approved apprenticeship committee. If the contractor elects to follow the CAC rules, pursuant to CCR 230.1, the apprentices “must at all times work with or under the direct supervision of journeyman/men.”

This is an obligation that is in effect whenever a worker paid as an apprentice is working on the public works project. Thus, apprentices, who are not at all times working with or under a journeyperson for the classification of work in which the apprentice is being trained, must be paid not less than the journeyperson rate.

11-6 Apprentice Registration Requirements

Apprentices are permitted to work only if they are registered, individually, under a bona fide apprenticeship program that is registered and approved by the state Division of Apprenticeship Standards. Pre-apprentice trainees, or trainees in non-apprenticeable crafts, or others who are not appropriately registered will not be allowed to work on public works projects unless they are paid the full prevailing wage rate of a journeyperson.

For federally funded projects, the apprentices must be registered under a bona fide federally approved program. A separate federal apprentice registration must be received. If the apprentice is not registered in a federally approved program, the apprentice, while recognized by the state, is not recognized under federal regulations and must be paid at the federal journeyperson rate as shown in the Davis-Bacon wage determination.

11-6-1 Verify Apprentice Registrations

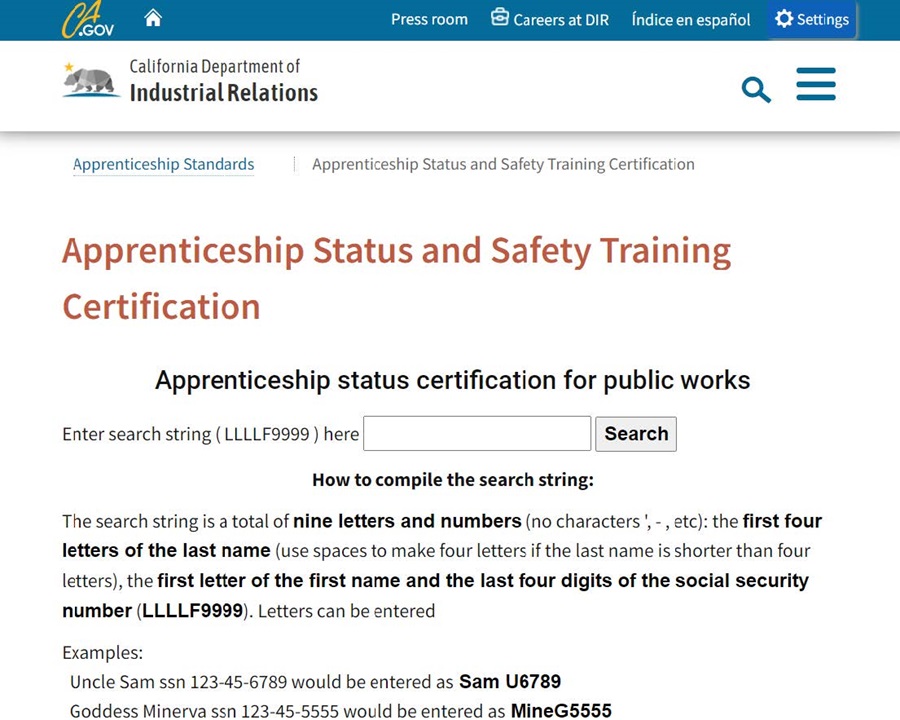

State apprentice certifications can be verified on the DAS website. Figure 11-C, “DAS Website Search,” shows an example.

FIGURE 11‑C: DAS WEBSITE SEARCH

Step 1: Search for apprentice status by using the first four letters of the worker’s last name and the last 4 digits of their Social Security number.

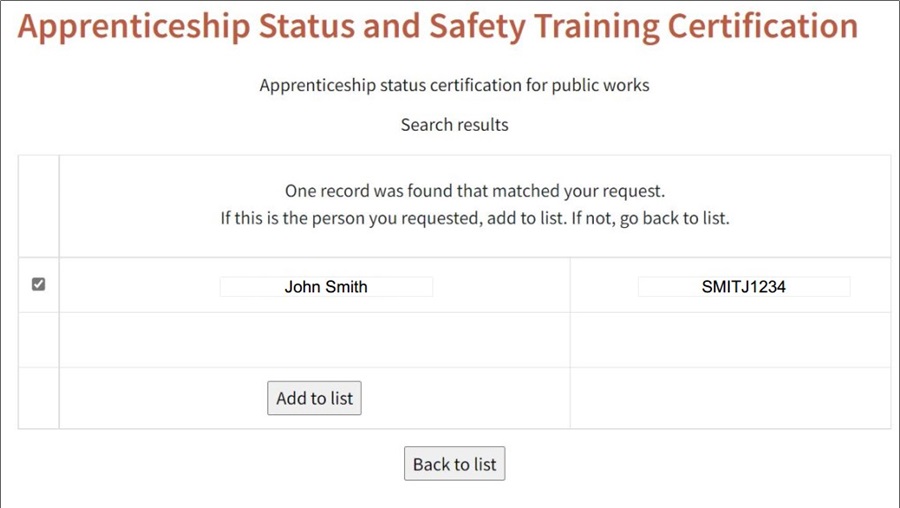

Step 2: If the worker is certified as an apprentice, a record will exist for that person. Click Add to List to add the record to the list to view the worker’s apprenticeship certification as shown in Figure 11-D, “DAS Website Search Results.”

FIGURE 11‑D: DAS WEBSITE SEARCH RESULTS

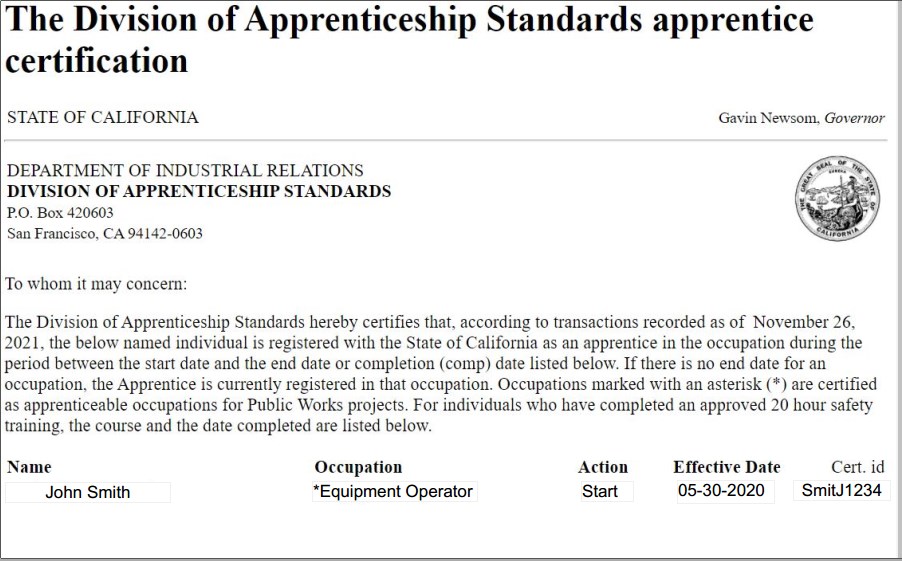

Step 3: Once the worker is added to the list, you can click a link to view the certification, as shown in Figure 11-E, “Apprentice Certification Display.” The apprentice certification will be displayed and can be printed.

FIGURE 11‑E: APPRENTICE CERTIFICATION DISPLAY

Federal apprentice certificates must be provided by the contractor during the first payroll for which the apprentice appears on a federally funded project. There is no online database to search and locate the certificate.

Federal certificates expire and must be reissued every 90 days. Contractors should submit certificates as long as the apprentice is employed on the public works project.

11-7 Forms DAS-140 and DAS-142

CCR 230 and Section 1777.5 of the California Labor Code require general contractors and subcontractors to apply for and employ apprentices. Contractor responsibilities for using these forms are detailed in the following sections.

11-7-1 Form DAS-140: Submit Contract Award Information

Approved Contractors:

Contractors that are already approved to train apprentices and are members of a DAS recognized apprenticeship committee, must provide contract award information to the apprenticeship committee for each applicable apprenticeable craft or trade in the area of the site of the public works project.

- Public works project information must be submitted in writing and within 10 days of the date of the contract award but in no event later than the first day the contractor has workers employed on the public works project.

- Form DAS-140 may be used for this purpose. Form DAS-140 is a notification of award and is not automatically a request for dispatch of a registered apprentice.

Non-Approved Contractors:

If not already approved to train by an apprenticeship committee, the contractor must submit the contract award information using Form DAS-140 to every apprenticeship program in the geographic area of the public works project, for each craft to be employed on the project.

The contract award information must be in writing and submitted to the applicable committee within 10 days of the date of the contract award but in no event later than the first day the contractor has workers employed on the public works project. This is simply a notification of award; it is not automatically a request for dispatch of a registered apprentice.

Information on applicable apprenticeship programs in approved geographic locations is available on the DIR website.

11-7-2 Form DAS-142: Employ Registered Apprentices

A contractor on a public works project must employ 1 hour of apprentice work for every 5 hours performed by a journeyperson. Exemptions may exist for a particular craft or trade. To determine if any exemptions exist, check the DAS Important Notices.

Contractors who do not already employ enough apprentices to meet the ratio requirements must:

- Use Form DAS-142 to request dispatch of an apprentice from an apprenticeship program for each apprenticeable craft or trade in writing and sent by first class mail, fax or email.

- The request must be submitted to the apprenticeship programs at least 72 hours before the date on which apprentices are required, excluding Saturdays, Sundays, and holidays.

Contractors that do not receive a sufficient number of apprentices from their initial request must request dispatch apprentices from all other apprenticeship committees, if more than one exists in the area of the public works project.

11-8 Training Fund

Contractors must contribute to the training fund in California in the amount identified in the prevailing wage rate publication for journeypersons and apprentices. The training fund was established to assure that new apprentices will be guaranteed the highest level of training, and to assure replacements for retiring skilled workers.

Contractors that contribute to an apprenticeship program are entitled to a full credit in the amount of those contributions. Contractors that do not contribute to an apprenticeship program must submit their contributions to:

DIR – California Apprenticeship Council (CAC)

P.O. Box 511283

Los Angeles, CA 90051-7838

Training fund contributions to the California Apprenticeship Council are due and payable on the 15th day of the month for work performed during the preceding month. The contribution should be paid by check and be accompanied by a completed Form CAC-2, “Training Fund Contribution Form.”

11-8-1 Confirm Training Fund Contributions

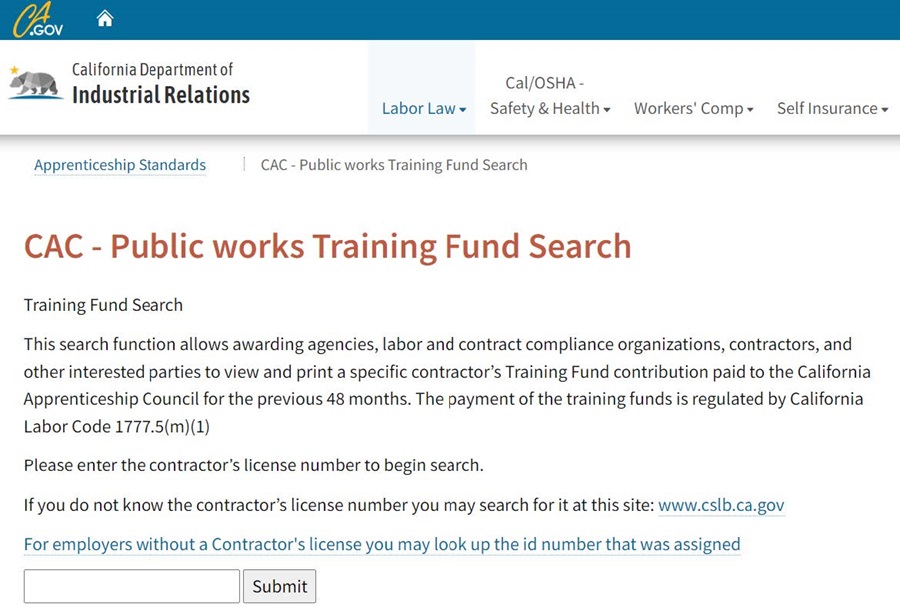

Payment status by contractors and subcontractors can be verified at the CAC - Public Works Training Fund Search site, as shown in Figure 11-F, “Training Fund Search.”

FIGURE 11‑F: TRAINING FUND SEARCH

11-9 Ratio Requirements

The ratio of work performed by apprentices to journeypersons employed in a particular craft or trade on public works projects cannot be greater than the ratio stated in the apprenticeship standards. The minimum ratio requirement is for each individual craft and only includes straight time hours.

The ratios designated in the agreements relate to hours between journeypersons and apprentices. These hours are for the total public works project and are not calculated on a daily basis. These hours can be attained at any time during the project. An apprentice must work 1 hour for every 5 straight time journeyperson hours for each separate craft worked on the contract.

For example:

- If there is a total of 100 journeyperson hours at the end of a project, you would need 20 apprentice hours in that same craft.

Note: Only straight time hours count. Be careful and check that the contractor did not confuse premium pay with overtime pay.

Exemptions may exist for a particular craft or trade. To determine if any exist, check the DAS Important Notices. When the ratio of apprentices to journeypersons is in question, request a copy of the Apprentice Program Standards for the apprenticeship program the registered apprentice is employed under to determine if there is a ratio violation.

Notify the Division of Apprenticeship Standards of the apparent minimum-ratio violation, in writing.

For maximum-ratio violations, determine the excess hours worked to be paid at the journeyperson wage rate, thereby assuring compliance with the maximum ratio.

Labor Compliance Manual Chapters

Chapter 1 - History, Laws and Regulations Governing Prevailing Wage Requirements

Chapter 2 - Governing Agencies

Chapter 3 - Caltrans Labor Compliance Program and Related Requirements

Chapter 4A - Division of Construction-Administered Contracts

Chapter 4B - Other Division-Administered Contracts

Chapter 5 - State Wage Determination

Chapter 6 - Federal Wage Determinations

Chapter 7 - Labor Compliance File

Chapter 8 - Pre-Job Conference Requirements and Posters

Chapter 9 - Determining Prevailing Wage Covered Work

Chapter 10 - Classification of Labor and Required Rates of Pay

Chapter 11 - Apprentice Requirements

Chapter 12 - Federal Trainee Requirements

Chapter 13 - Weekly Certified Payroll Records

Chapter 15 - Payroll Review and Confirmation

Chapter 17 - Notification Process

Chapter 18 - Employee Interviews and Equal Employment Opportunity (EEO) Compliance

Chapter 19 - Complaints Process

Chapter 20 - Audits and Investigations Process

Chapter 21 - Wage Case Submittal

Chapter 22 - Restitution Collection