Chapter 10: Classification of Labor and Required Rates of Pay

- 10-1 Introduction

- 10-2 Identifying the Correct Classification

- 10-3 Wage Rates

- 10-4 Pre-Determined Increases

- 10-5 Footnotes

- 10-6 Exemptions

10-1 Introduction

Labor standards require the proper classification and payment of workers for the work they perform at the worksite, not the title or status of the worker. To meet these standards, the contractor and persons or firms performing the work on the project must:

- Use only the classification listed in the DIR prevailing wage determination decision or the federal Davis-Bacon Act (DBA) determination applicable to the contract. For example, a foreperson pulling wire should be classified and paid as an electrician.

- Use the appropriate published classifications that describe the work being performed by the worker. For example, if a worker is used to place reinforcing steel, they should be shown as ironworkers and paid accordingly.

- Maintain an accurate record of the time spent in each work classification and show this time by means of separate entries in the payroll records and on the certified payroll.

Once the correct craft or classification has been determined as discussed in Chapter 9, “Determining Prevailing Wage Covered Work,” of this manual, the next step is to determine the appropriate general prevailing wage rate. Wage rates are set at both the state and federal level. Projects that receive only state funds are governed solely by the DIR wage determination. For projects that receive federal funds, the federal Davis-Bacon rates must be compared with the state prevailing wage rate, and the contractor must pay the higher of the two.

The following sections describe the process for identifying the proper classification for workers based on the type of work performed by the worker.

10-2 Identifying the Correct Classification

10-2-1 Worker Classification

Determining a worker’s classification and associated rate of pay depends entirely on the specific tasks performed by a worker. The worker’s title or designation within their firm, such as owner, or officer, is not relevant to their prevailing wage status. The following questions can help establish a worker’s prevailing wage designation:

- Do the worker’s activities meet the criteria set forth in Labor Code Section 1720 and Section 1771?

- Is there a specific DIR classification for the work?

- The DIR wage determination scope of work describes the specifications for each job classification and can be used to identify the appropriate rate of pay for the worker.

- If the scope of work does not include the work performed, the classification is not appropriate.

- Is the work determined to be covered by prevailing wage, but not listed in the DIR wage determination?

- If the prevailing wage is not listed, contact the Labor Compliance unit at headquarters to decide if a classification needs to be added by the DIR. If needed, the headquarters Labor Compliance unit can help to find the proper classification and contact the DIR.

- For federal classifications, a similar process is available through the conformance process if the proper classification is not part of the federal Davis-Bacon wage decision, and if the scope of work is not closely related to other work performed under the contract.

- Sometimes employers may use workers in classifications other than those shown in the prevailing wage determinations, by matching the type of work being performed to an existing classification that most closely aligns with the scope of work performed.

Note: If you are unable to locate the proper wage rate in a published Scope of Work for the work to be performed, check with headquarters Division of Construction Labor Compliance unit at the beginning of a project for review and guidance.

10-2-2 Resources to Help Identify the Proper Classification

The following can help to determine the proper classification:

- Consider the specific work performed, including the tools and equipment that are used.

- Check the resident engineer’s or assistant resident engineer’s daily report or project records for equipment information.

- Ask the resident engineer, or Caltrans onsite designee, to describe the work performed.

- Review the detailed scope of work in the DIR wage determination and compare to the tasks performed by the worker. Additional resources may be identified in Section 14-2-1, “Classifications,” of this manual. Figure 10-A, “How to Identify Classifications in Scope of Work,” offers tips.

FIGURE 10‑A: HOW TO IDENTIFY CLASSIFICATIONS IN SCOPE OF WORK

|

Scope of Work Classification Comparisons |

|

The information inside the scope of work must be carefully analyzed. The descriptions are often non-specific and can be interpreted in a number of ways. Key words or statements may limit or expand on what a classification can or cannot do. Examples of key words and statements include:

Sample Scenarios: The electrician scope of work may include “equipment incidental to” work related to pull boxes. Therefore, if an electrician operates a backhoe to dig a trench to reach the pull box, the equipment is incidental to the electrician’s work and can be paid at the electrician rate. A laborer may lay and install pipe on new construction. Because the laborer scope of work limits the laborer’s function to laying and installing, a laborer cannot repair, adjust, or remove pipe that already has been installed. |

10-2-3 Classification Groups

Some classifications are organized by group or specific tasks. This includes laborer, teamster, and operating engineer. It is important to assign the proper classification because the wage rates differ between subgroups.

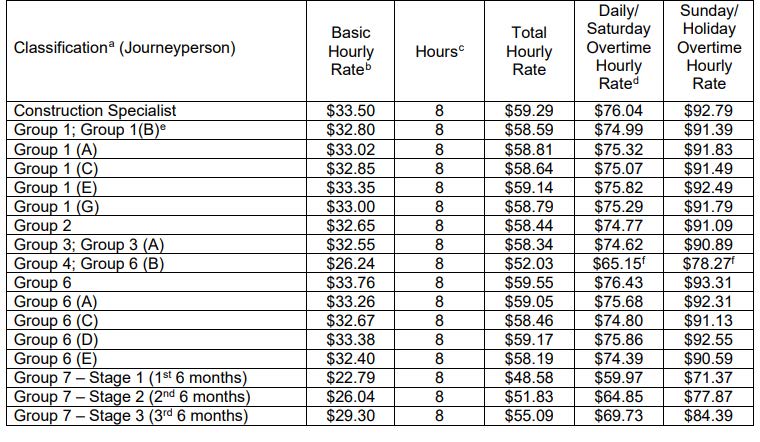

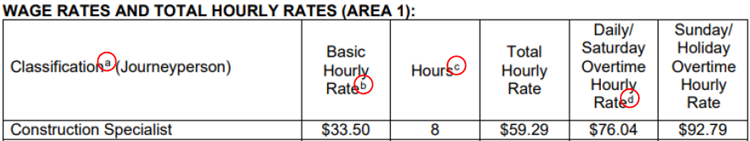

Table 10-B, “Wage Rates and Total Hourly Rates (Area 1),” is a sample of laborer groups and associated rates.

TABLE 10‑B: WAGE RATES AND TOTAL HOURLY RATES (AREA 1)

10-2-4 Single Worker Performing Under Multiple Classifications

Considering that prevailing wage is based upon the specified prevailing rates for work of a similar character pursuant to Labor Code Sections 1771 and 1774, it is possible that one worker may perform more than one type of work on a project.

The following should be evaluated under this circumstance:

- If different work is performed within the same primary craft, the contactor can pay the higher rate, for example, Laborer Group 3 and Laborer Group 4 work.

- When the crafts are different, the contractor technically cannot pay the higher rate because of apprentice requirements and other issues. In that case, the contractor would need to report them separately as different crafts.

For example, if an employee drives a 3-axle dump truck four hours and works as a laborer for four hours, the wage rates would reflect four hours as a truck driver teamster and four hours as a laborer.

10-3 Wage Rates

The DIR wage determination identifies the following rate categories. These rates are required for all workers who perform prevailing wage work that falls within a specific DIR published classification. All rate types must be applied during the certified payroll review process to assure compliance:

- Basic hourly rate

- Employer payments, fringe benefits

- Daily overtime

- Saturday premium

- Sunday premium

- Holiday rate

- Travel

- Footnotes

- Predetermined increases

Table 10-C, “Wage Rates,” lists how wage rates are calculated for classifications.

TABLE 10‑C: WAGE RATES

|

RATE TYPE |

RATE CALCULATION |

|

Total hourly rate |

Basic hourly rate + fringe benefits |

|

Overtime |

(Basic hourly rate x 1.5) + fringe benefits |

|

Saturday premium |

(Basic hourly rate x 1.5) + fringe benefits |

|

Sunday premium |

(Basic hourly rate x 2) + fringe benefits |

|

Holiday Rate |

(Basic hourly rate x 2) + fringe benefits |

10-3-1 Basic Hourly Rate Requirements

General prevailing wage determinations include both a basic hourly rate and the total hourly rate for each location and classification. Employers are required by California Labor Code Section 1774 to pay employees the basic hourly rate as the minimum hourly wage for all hours worked.

The total hourly rate includes the basic hourly rate and additional compensation for employer payments, which are typically fringe benefits such as health insurance, vacation, and pension fund contributions. Total compensation paid by the employer to the employee must match the total hourly wage set by the DIR for general determination.

10-3-2 Employer Payments, Fringe Benefits

In addition to the basic hourly rate, the contractor must pay the amounts identified as employer payments on the wage determination either to, or on behalf of, the employee.

Typical fringe benefits that are listed in the prevailing wage rates include:

- Vacation

- Health benefits

- Pension fund contributions

- Training funds

Employer Payment Credits

Under Labor Code Section 1773.1(b), employer payment credit may be given toward the total hourly rate if payments meet the Labor Code requirements.

If the contractor does not make payments to receive credit for fringe benefits, the amount identified must be paid as cash directly to the worker and incorporated into the basic hourly rate to meet the total hourly rate requirement.

For crafts identified as apprenticeable by the DIR, the amount identified in the training column of the wage determination is a mandatory fringe benefit payment pursuant to Labor Code 1777.5(m)(1). A contractor must pay the amount to either California Apprenticeship Council or a state approved apprenticeship program. The contractor cannot meet this obligation by paying the amount directly to the worker. Figure 10-D, “Employer Payments,” lists requirements.

FIGURE 10‑D: EMPLOYER PAYMENTS

| Employer Payment Requirements |

|

Contributions made by employer to a third-party plan, fund, or program, such as medical or pension:

Does not include:

For actual costs reasonably anticipated to benefit worker, such as vacation, paid time off, or holiday credit:

|

Form CEM-2501, “Fringe Benefit Statement,” must provide the following:

- Sufficient information to satisfy questions regarding the adequacy of payments to any third-party administrator, such as a union trust fund or other deductions.

- Indication to whom the fringe benefits were paid for each classification, such as a trust fund or as a cash payment made directly to the employee.

- Signature on the form submitted with the first submitted payroll and each time a change is made in any fringe benefit schedule. Employers may use any method to indicate payment of fringe benefits as long as the amount of each payment can be verified from an examination of the payroll form, fringe benefit statement, or other source documents.

10-3-3 Travel

Travel pay is considered per diem pay under Labor Code Section 1773.1 and covers both travel and subsistence payments for certain types of work. Amounts for travel and subsistence have typically been a fixed amount paid to the workers pursuant to the terms of a collective bargaining agreement that was adopted by the DIR for a specific location.

These amounts are not specifically identified in the published wage determinations and appear only in the determination footnotes under the heading “Travel and/or subsistence payment,” as shown in Figure 10-E, “Travel and Subsistence Pay.”

FIGURE 10‑E: TRAVEL AND SUBSISTENCE PAY

The location of the project usually determines if subsistence is required. If the project is in a location designated as a subsistence area, contractors are required to pay their employees subsistence. The subsistence payment must be shown on the certified payroll.

The travel and subsistence requirements are found on the DIR website as part of the prevailing wage determination under the drop-down box for Travel Provisions, as shown in Figure 10-F, “Travel and Subsistence Example.”

FIGURE 10‑F: TRAVEL AND SUBSISTENCE EXAMPLE

- When Travel is selected from the dropdown menu, the collective bargaining agreement displays all the subsistence information.

- When the project covers two or more subsistence areas or crafts, the contractor may choose to pay the higher rate for both areas and crafts.

- Subsistence payments for some crafts are based on the employee’s residence and location of the project. The labor compliance representative should check each collective bargaining agreement.

- Subsistence may be paid as a lump sum daily payment or as an increased hourly wage rate, depending on the craft, classification, and group for each employee as listed in the collective bargaining agreement.

Figure 10-G, “Travel Differences,” lists the differences between regular and compensable travel.

FIGURE 10‑G: TRAVEL DIFFERENCES

| Regular Travel vs Compensable Travel |

|

10-3-4 Overtime

The California Labor Code Sections 1810 - 1815 and the state Constitution require overtime to be paid for all hours worked more than 8 per day, or 40 hours per week. The overtime rate is one and one-half times the hourly rate of pay excluding the fringe benefits. Failure to pay the required overtime rates subjects the contractor to penalties under Labor Code Section 1813. Federal overtime penalties apply for overtime violations only in excess of 40 hours in a week.

The following key points summarize overtime requirements for public works projects:

- Workers must be paid the overtime prevailing wage rate for every hour worked past 8 hours in a single workday.

- Workers must be paid the overtime prevailing wage rate for every hour worked past 40 hours in a single workweek.

- Sunday rate of pay may be required based on specific classification. The information may be found on the wage determination footnotes, if it applies.

10-3-5 Saturday, Sunday, Holiday

In addition to standard overtime, workers being paid a prevailing wage must be paid applicable Saturday or Sunday rates of pay as identified on the wage determination and on recognized legal holidays, no matter how many hours they worked during the week. Since overtime and double time rates for weekend and holiday work are not always calculated at 1.5 times or double the regular prevailing wage rate, it is important to check the DIR prevailing wage determination for Saturday, Sunday, and holiday work to verify the rates by classification.

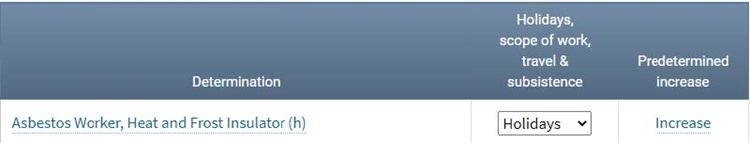

The premium rates for holiday pay are found on the DIR website as part of the prevailing wage determination. Figure 10-H, “Holiday Pay Example,” is a screen shot from the DIR website.

FIGURE 10‑H: HOLIDAY PAY EXAMPLE

Select Holidays on the dropdown menu.

The page from the collective bargaining agreement is displayed and provides the holiday information for the selected classification.

Holiday rates of pay only applies to the classification’s recognized holidays. For example, California government employees have Cesar Chavez Day as a holiday, but work performed on Cesar Chavez Day is not a recognized holiday for laborer classification; therefore, holiday rate of pay would not be required for laborers performing work on Cesar Chavez Day.

10-3-6 Overtime Rate Exceptions

While the general rule requires payment of overtime pursuant to the applicable wage determination, there are four limited exceptions under 8 CCR 16200(a)(3)(F).

Exception 1:

If a workweek other than Monday through Friday is a fixed business practice or is required by the awarding body, no overtime payment is required for the first eight hours on Saturday or Sunday. The fixed business practice portion of this exemption is construed narrowly. It will not be permitted in circumstances where the contractor cannot establish that such a practice exists on all its projects, including public and private projects.

Exception 2:

If the collective bargaining agreement provides for Saturday and Sunday work at straight-time, no overtime payment is required for the first 8 hours on Saturday or Sunday.

Exception 3:

If the awarding body determines that work cannot be performed during normal business hours, or work is necessary at off hours to avoid danger to life or property, no overtime is required for the first 8 hours in any one calendar day, and 40 hours during any one calendar week.

Exception 4:

No overtime payment is required for less than 40 hours in a standard work week, or for less than 8 hours in a calendar workday, unless specified in the collective bargaining agreement used as the basis for the prevailing wage determination.

10-3-6A Saturday and Sunday Rate Exceptions

The following special provisions may serve as exceptions for Saturday and Sunday overtime requirements:

- When there are constraints in the contract, such as lane charts with shift and weekend restrictions that require a contractor to work other than Monday through Friday, it is permissible to work Sunday night through Thursday night and pay the straight time rate on Sunday night. The contractor must submit a request for this exception in writing to the resident engineer.

- Some classifications have overtime exceptions and may be paid straight time on Saturday if a job work stoppage is because of inclement weather that occurred during that week.

However, if employees work more than 8 hours a day or 40 hours a week, employers must pay overtime.

Further clarification of exceptions to Saturday and Sunday overtime rates are found in CCR 16200.

10-4 Pre-Determined Increases

10-4-1 Predetermined Increases, Double Asterisk

When issued, many individual craft or classification determinations include pre-negotiated or pre-determined future increases for a specified time period. Pre-determined increases are known and specified in the applicable collective bargaining agreement at the time of the bid advertisement date and are referenced in the general prevailing rate of per diem wages. They may increase the basic hourly wage rate, overtime, holiday pay rates or employer payments.

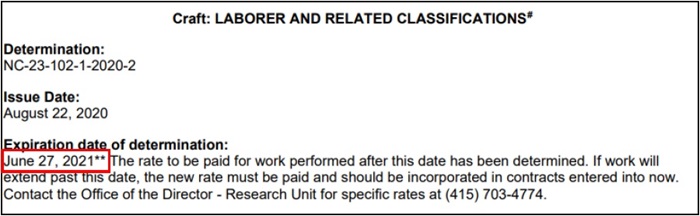

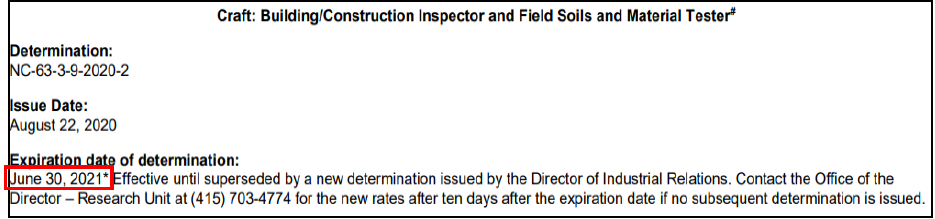

Each prevailing wage determination includes an expiration date. This is defined as the date upon which the determination is subject to change in accordance with 8 CCR 16000. If there are predetermined increases, the expiration date will be followed by a double asterisk, as shown in Figure 10-I: “Expiration Date of Determination.”

FIGURE 10‑I: EXPIRATION DATE OF DETERMINATION

The new prevailing wage rate goes into effect on the day following the expiration date listed in the determination. Figure 10-J, “Holiday Pay Example,” shows how to find the pay.

FIGURE 10‑J: HOLIDAY PAY EXAMPLE

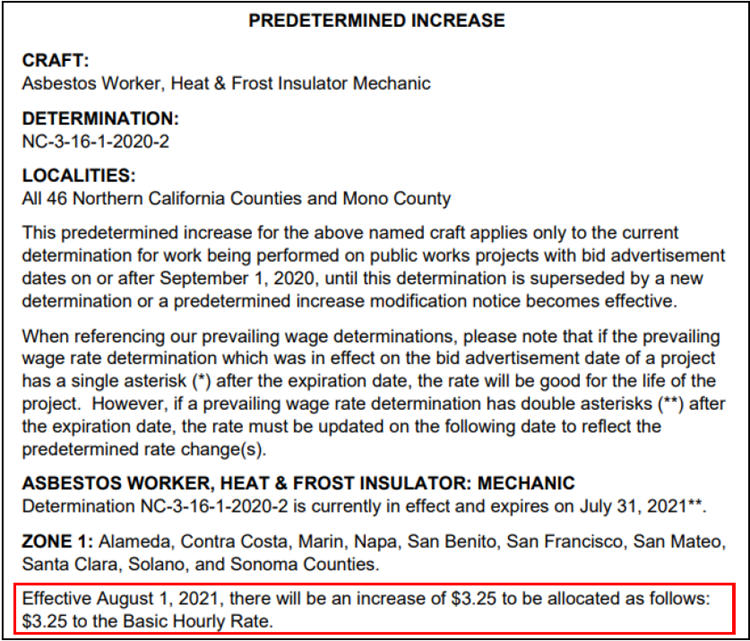

The predetermined increase amounts are available on the DIR Office of Policy, Research, and Legislation webpage, and specify the date upon which the increases must be paid to workers, as shown in Figure 10-K, “Predetermined Increase.”

FIGURE 10‑K: PREDETERMINED INCREASE

10-4-2 Expiration Date, Single Asterisk

If there are no predetermined changes, the expiration date on each prevailing wage determination will be followed by a single asterisk, as shown in Figure 10-L, “Expiration Date.” The single asterisk indicates that the rates listed on that wage determination apply for the duration of the project.

FIGURE 10‑L: EXPIRATION DATE

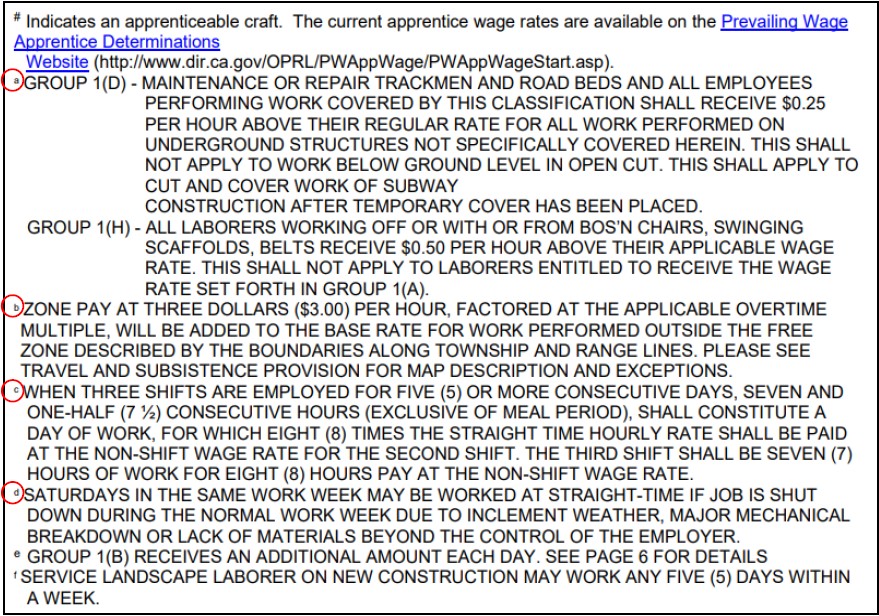

10-5 Footnotes

It is important to pay attention to footnotes listed on the general prevailing wage determination, as shown in Figure 10-M, “Footnotes.” The footnote typically indicates an additional rate that needs to be applied to the base rate or fringe benefits or both.

FIGURE 10‑M: FOOTNOTES

10-6 Exemptions

There are a few exceptions to California's prevailing wage laws. Exemptions may be found in Labor Code 1720.4. The following are some of the most common exceptions:

- Volunteers - Workers who perform work for civic, humanitarian, or charitable reasons and who do not expect compensation in return. Volunteer work must be for a public agency or corporation that is qualified as a tax-exempt organization by the Internal Revenue Service.

- Charter Cities - Cities in which the governing system is defined by their own charter document and not by general law. California's prevailing wage laws do not apply to work performed in charter cities.

- Federal Projects – Contracts funded by federal money do not fall under California's prevailing wage laws that govern state projects. California’s prevailing wage laws generally do not apply to federal projects if there is no state, county or city funding. However, Caltrans must still require state prevailing wage requirements on all its contracts, regardless of whether there is state funding. Obtain a copy of the federal laws that govern wages paid to employees working on federal projects.

Labor Compliance Manual Chapters

Chapter 1 - History, Laws and Regulations Governing Prevailing Wage Requirements

Chapter 2 - Governing Agencies

Chapter 3 - Caltrans Labor Compliance Program and Related Requirements

Chapter 4A - Division of Construction-Administered Contracts

Chapter 4B - Other Division-Administered Contracts

Chapter 5 - State Wage Determination

Chapter 6 - Federal Wage Determinations

Chapter 7 - Labor Compliance File

Chapter 8 - Pre-Job Conference Requirements and Posters

Chapter 9 - Determining Prevailing Wage Covered Work

Chapter 10 - Classification of Labor and Required Rates of Pay

Chapter 11 - Apprentice Requirements

Chapter 12 - Federal Trainee Requirements

Chapter 13 - Weekly Certified Payroll Records

Chapter 15 - Payroll Review and Confirmation

Chapter 17 - Notification Process

Chapter 18 - Employee Interviews and Equal Employment Opportunity (EEO) Compliance

Chapter 19 - Complaints Process

Chapter 20 - Audits and Investigations Process

Chapter 21 - Wage Case Submittal

Chapter 22 - Restitution Collection