Chapter 14: Daily Reports

14-1 Introduction

During contract administration, the assistant resident engineer uses their knowledge and experience of fieldwork to complete Form CEM-4601, “Assistant Resident Engineer’s Daily Report.” The assistant resident engineer’s daily reports contain the name of the contractor and subcontractors performing work and all pertinent information including:

- Hours

- Classifications

- Employee names

- Equipment used and who used it

- Items of work performed on the job site

The daily report should also indicate if severe weather or any work stoppage occurred during the week, or if only a partial inspection was performed.

Shift hours found in the upper right-hand corner of the form apply to the contractor’s hours, not the inspector’s hours. If any information is unclear, contact the resident engineer or the inspector filling out the daily report.

14-2 Daily Report Reviews

14-2-1 Classifications

Verify that the classification listed by the assistant resident engineer is the proper classification for the work performed. Consult the assistant resident engineer or resident engineer, when there is a conflict between the daily report and payroll records, or if clarification is needed.

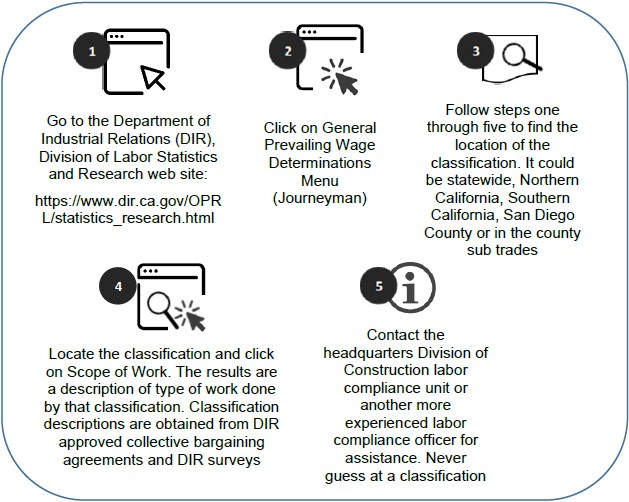

How to determine classifications:

- Go to the Department of Industrial Relations (DIR), Division of Labor Statistics and Research website:

https://www.dir.ca.gov/OPRL/statistics_research.html

- Click on General Prevailing Wage Determinations Menu (Journeyman).

- Follow steps 1 through 5 to find the location of the classification. It could be statewide, Northern California, Southern California, San Diego County or in the county sub trades.

- Locate the classification and click on Scope of Work. The results are a description of the type of work done by that classification. Classification descriptions are obtained from DIR approved collective bargaining agreements and DIR surveys.

- Contact the headquarters Division of Construction Labor Compliance unit or a more experienced labor compliance officer for assistance. Never guess at a classification. Figure 14-A, “How to Determine Classifications,” offers guidance.

FIGURE 14‑A: HOW TO DETERMINE CLASSIFICATIONS

14-2-1(a) Multiple Classifications for the Same Type of Work

There may be multiple classifications for the same type of work. For example, the daily report may list pilot car driver, and the payroll lists the employee as a laborer. Pilot car is on the Traffic Control/Lane Closure Laborer classification and found under Teamster Group 1 under the current DIR publication in Northern California. Since both the teamsters and the laborers claim a pilot car driver, the contractor may use either of the two classifications.

14-2-1(b) Owners, Partnerships, and Corporate Officers

California Labor Code requires that anyone performing skilled or unskilled labor on a project must be paid the hourly prevailing wage rates established for that classification or type of work regardless of title, status, certification or any employment relationship, including but not limited to: owner, sole proprietor, superintendent, president, and owner-operator.

Prevailing wage requirements do not apply to owners, corporate officers or partners who are only performing duties in an administrative, project management or supervisory capacity and not performing the function of a worker or laborer.

14-2-1(c) Supervisory and Managerial Personnel

- Employees whose work is supervisory or non-manual in nature are not considered laborers or mechanics. The fact that an employee is salaried or is called a foreperson does not mean that the person may not be a laborer or mechanic.

- If a salaried employee or a supervisor performs journeyperson work for a significant part of the day, the employee is considered a journeyperson for that portion of the day and is subject to the payment of prevailing wages for the classification of work performed.

14-2-2 Extra Work Bills

All extra work bills must be checked for the proper use of labor classifications, hours worked, and rates of pay against daily reports and certified payrolls provided by the contractor. The resident engineer or labor compliance representative make these checks. Two scenarios may occur from discrepancies when crosschecking these documents.

14-2-2(a) Example 1

The contractor has overcharged on the extra work bill. This would occur when the contractor:

- Listed wages higher than what was shown on the payroll

- Listed more hours than the employee worked

- Used classifications that require a higher rate of pay than the classification for the work that was performed

- Listed an employee who did not work

If a discrepancy is noted, contact the resident engineer.

14-2-2(b) Example 2

The resident engineer has verified that the extra work bill has the correct hours, wages, and classifications, but one of the following has occurred:

- An employee on the extra work bill who worked is not listed on the payroll.

- The hours on the payroll are less than the extra work hours and the hours shown on the daily report.

- The wages shown on the payroll are less than the minimum wages due and less than those shown on the extra work bill.

The labor compliance representative must schedule a source document review to investigate payroll discrepancies. In this scenario, the extra work bill can be paid because the problem is not with the billing.

Labor Compliance Manual Chapters

Chapter 1 - History, Laws and Regulations Governing Prevailing Wage Requirements

Chapter 2 - Governing Agencies

Chapter 3 - Caltrans Labor Compliance Program and Related Requirements

Chapter 4A - Division of Construction-Administered Contracts

Chapter 4B - Other Division-Administered Contracts

Chapter 5 - State Wage Determination

Chapter 6 - Federal Wage Determinations

Chapter 7 - Labor Compliance File

Chapter 8 - Pre-Job Conference Requirements and Posters

Chapter 9 - Determining Prevailing Wage Covered Work

Chapter 10 - Classification of Labor and Required Rates of Pay

Chapter 11 - Apprentice Requirements

Chapter 12 - Federal Trainee Requirements

Chapter 13 - Weekly Certified Payroll Records

Chapter 15 - Payroll Review and Confirmation

Chapter 17 - Notification Process

Chapter 18 - Employee Interviews and Equal Employment Opportunity (EEO) Compliance

Chapter 19 - Complaints Process

Chapter 20 - Audits and Investigations Process

Chapter 21 - Wage Case Submittal

Chapter 22 - Restitution Collection