Chapter 21: Wage Case Submittal

- 21-1 Introduction

- 21-2 Wage Case Documents: CEM Forms and Documentation

- 21-3 Review of Submittal Documents

- 21-4 Timeline

- 21-5 Administrative Hearing Process

- 21-6 Debarment of Contractors

21-1 Introduction

Upon conducting a source document review and subsequent full investigation, and determining that a labor compliance violation has occurred, the violating contractor is given an opportunity to clear the violations. If violating contractor fails to clear the addressed violations by the given due dates, a labor compliance wage case is prepared. The wage case can be against the prime contractor, first-tier subcontractors, or any lower tier subcontractors.

A wage case should include the source document review, statements from complainants and witnesses, employee interviews, tips from outside sources such as unions and joint labor organizations, and other contractors. Analyze all evidence provided by the contractor to refute or confirm conclusions.

Caltrans does not have statutory authority for approving or ruling on determinations of California Labor Code violations. When Caltrans has found a violation of state prevailing wage laws and ordered a withholding of contractor funds, the contractor has a right to a hearing administered by the Department of Industrial Relations (DIR). State labor compliance violators are entitled to participate in an administrative hearing process administered through the DIR to arrive at the final determination of a labor code violation.

The Federal Highway Administration (FHWA) has delegated authority to Caltrans for federal labor contract compliance. Appeals to final determinations for wage cases based on federal law are addressed in federal court.

21-2 Wage Case Documents: CEM Forms and Documentation

The district Labor Compliance officer should include the following documents in the labor violation wage case when submitting it to headquarters Division of Construction labor compliance wage case administrator for review:

- Labor Compliance Checklist

- Review all checked and unchecked items

- Read through the Summary sections A-E (pages 3-5)

- What happened: such as violations, actions taken, evidence

- Check for a Wage Case Timeline or Case History if any

- Form CEM-2506, “Labor Compliance Wage Violation”

- Confirm and verify documentation used to complete Form CEM 2506:

- Certified payroll records

- Daily reports

- Timesheets

- DIR prevailing wage determination year and rates

- DOL Davis-Bacon wage determination and rates

- Other, such as employee earnings statements, or contractor records

- Confirm and verify that the information reflected on the evidence: prevailing wage rates, certified payroll records, daily reports, timesheets, matches what is reflected on the Form CEM-2506 spreadsheet:

- Employee name and information, for example, classification and addresses

- Employee work days or hours or shifts

- Rate of pay, fringe benefits, training fees

- Comments section: Are there any explanations or references noted?

- Double-check the formulas on the spreadsheet. You may have to manually check the calculations and totals reflected on the Form CEM-2506 spreadsheet summary tab.

- Summary tab: The Penalty End Date for the California Labor Code Section 1776 calculation must be determined by headquarters management. This date is usually the same date as when headquarters management signs the Request for Approval of Forfeiture (RAF).

- Form CEM 2507, “Labor Violation Case Summary”

- Form CEM 2508, “Contractor Payroll Source Document Audit Summary”

- Form CEM 2509, “Checklist - Source Document Audit”

- Employee complaints and witness statements

- Correspondence between the Labor Compliance officer and the prime contractor pertaining to the wage violation

- Case history

- Copy of the signed certified mail receipt

This form is used to record each employee’s classifications, hours and wages in order to calculate any underpayment. Attach a copy of the spreadsheet that was sent to the violating contractor showing a summary of wages and penalties due each employee.

This form is used to summarize the data on Form CEM-2506 and provide a chronological record of the case. Attach an analysis of the facts based on the source document review, certified payroll documentation, and calculations shown on Form CEM-2506.

Completion of the wage case checklist, along with all required forms, should be submitted to the Division of Construction headquarters’ Labor Compliance unit. Include the following information: a brief description of the work performed by the offending contractor; a description of the facts and documentation collected to build the labor compliance case, wages, and penalties due; and the Labor Compliance officer’s recommendations.

All source audit documents, including, but not limited to, contract daily reports, payroll and fringe benefit records, trust fund records, and statements made by the contractor that were used to complete the case audit or investigation should be submitted to headquarters’ Division of Construction Labor Compliance wage case administrator.

The district must submit all case information to the headquarters’ Division of Construction Labor Compliance wage case administrator 60 to 90 days before the statute of limitation expiration date on prevailing wage violations. The timing gives the wage case administrator sufficient time to process the case for submission to Department of Industrial Relations.

21-3 Review of Submittal Documents

Headquarters’ Division of Construction Labor Compliance wage case administrator will review of the wage case submittal documents, determine whether there is sufficient evidence to support the wage case, and notify the district Labor Compliance officer. The district Labor Compliance officer may provide additional support or withdraw and later resubmit the case to the headquarters’ Labor Compliance wage case administrator if there is sufficient time for review before the statute of limitation expires on the case.

If a wage case is accepted, the Labor Compliance wage case administrator prepares the case file and sends a Request for Approval of Forfeiture (RAF) letter to DIR for state violations. The RAF must include the Statement of Labor Case Findings describing the investigative process and findings on the case, a copy of Form CEM-2506, "Labor Compliance Wage Violation,” listing all violation underpayments and applicable state or federal penalties, or both.

Upon DIR’s approval of the RAF, the headquarters’ Division of Construction Labor Compliance wage case administrator sends a withhold memo to headquarters Division of Accounting, granting the authority to withhold wages, penalties, and liquidated damages. In addition, a copy of the approved RAF letter from DIR and a copy of the accounting memo granting the authority to withhold wages, penalties, and liquidated damages is forwarded to the district Labor Compliance officer.

21-3-1 District Labor Compliance Steps after Wage Case Acceptance

When the district receives notification of the RAF approval from DIR, the Labor Compliance officer must:

- Release any administrative deductions being withheld for labor compliance at this district level.

- Notify the resident engineer of case approval and headquarters’ accounting withhold on the contract. This notice is issued by the headquarters Labor Compliance wage case administrator.

21-4 Timeline

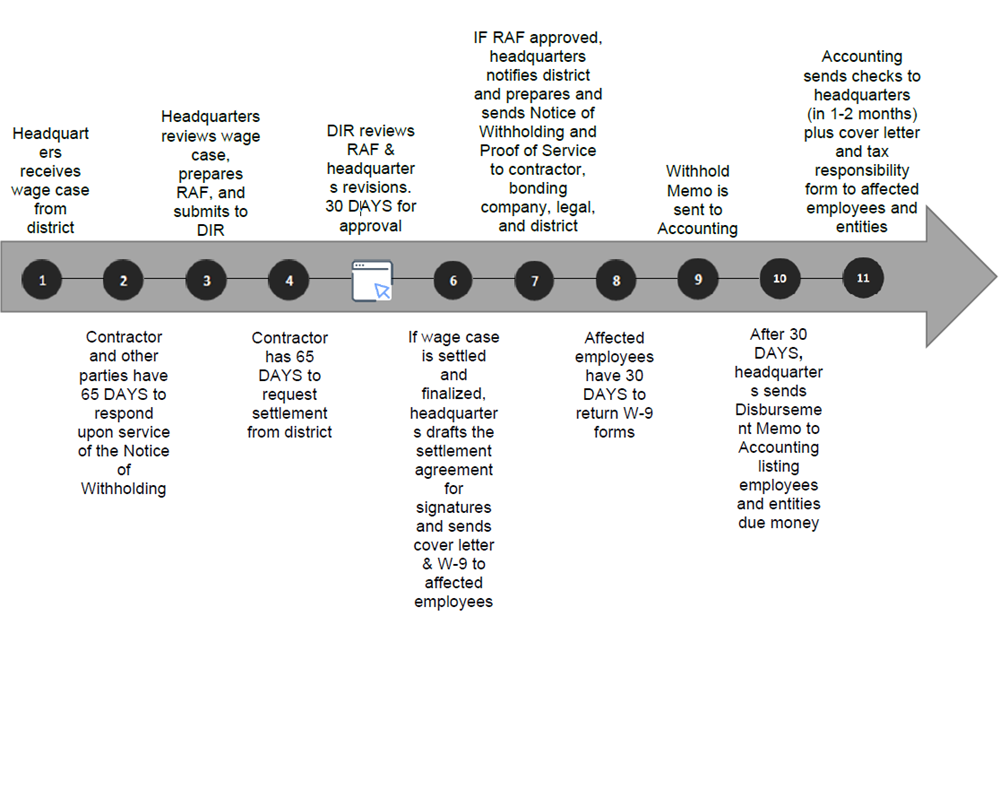

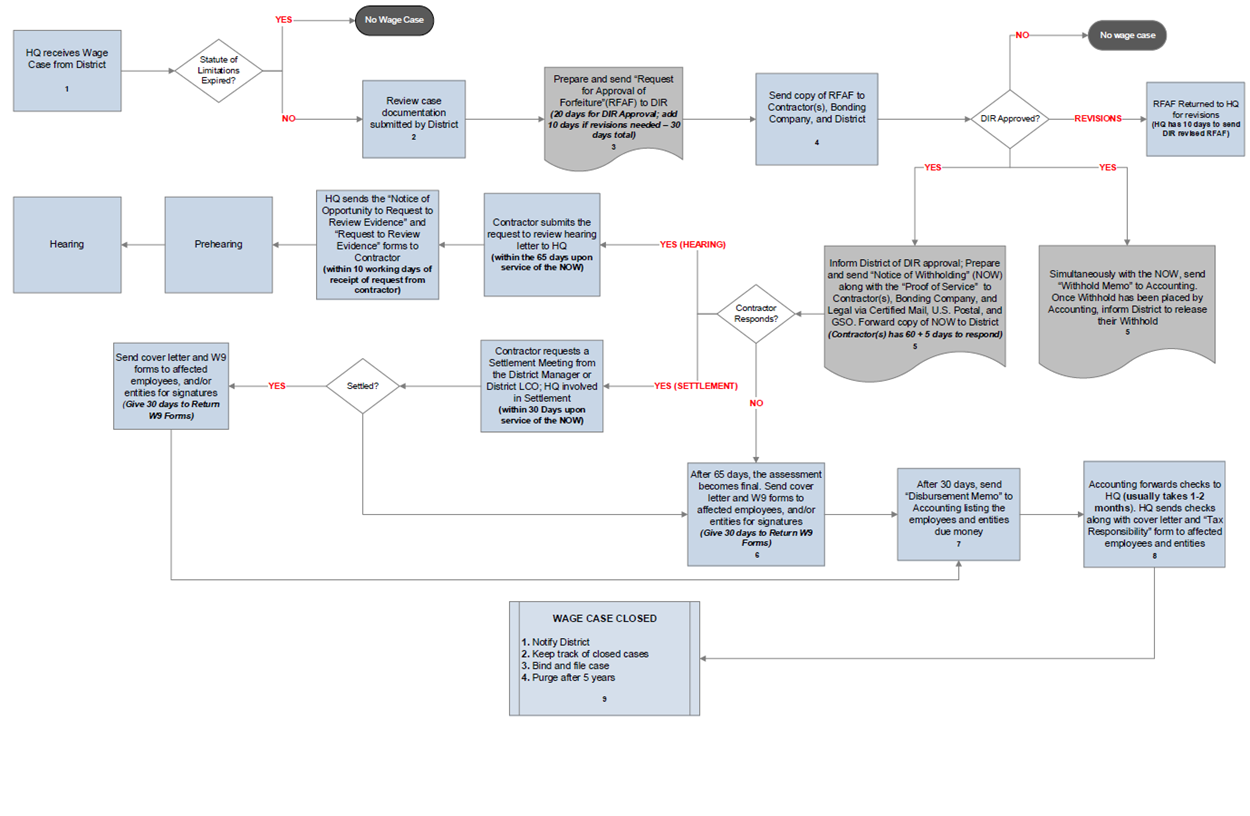

A Wage Case Timeline graphic is included at the end of this section, refer to Figure 21-A, “Wage Case Timeline.”

21-4-1 Request for Approval of Forfeiture

Headquarters receives wage case from district and determines if the statute of limitations has expired.

If the statute of limitations has not expired, headquarters reviews the case documentation and prepares a Request for Approval of Forfeiture (RAF) to DIR. A copy of the RAF is also sent to the contractors, contractor’s bonding company, and district.

DIR reviews of RAF and headquarters revisions within 30 days.

21-4-2 Request for Approval of Forfeiture Approval and Notice of Withholding

If the RAF is approved, headquarters notifies the district of DIR approval, prepares and sends copies of a Notice of Withholding (NOW) along with the proof of service to the contractors, bonding company, and Caltrans Legal Division. A copy is also forwarded to the district.

A withholding memo is simultaneously sent to headquarters Division of Accounting. Once the withhold has been placed by Accounting, inform the district to release their withhold.

The contractor and all other affiliated parties then have 65 days upon receipt of the Notice of Withholding to respond.

Liquated Damages

In accordance with California Labor Code Section 1742.1, the contractor, subcontractor, and bonding company are liable for liquidated damages in the amount equal to the wages that remain unpaid 60 days after receipt of the Notice of Withholding of Contract Payments.

21-4-3 After Service of the Notice of Withholding

No response to Notice of Withholding

If the contractor does not respond to the Notice of Withholding within 60 days, plus 5 days for postal services, the wage case assessment becomes final. Headquarters will send a cover letter and W-9 forms to the affected employees and entities for signatures.

Affected employees will have 30 days to return the signed W-9 forms. After 30 days, headquarters Labor Compliance will send a disbursement memo to Accounting listing the employees and entities due money.

Accounting will forward checks to headquarters in 1-2 months with a cover letter and tax responsibility form for affected employees and entities.

Note: Headquarters can only disburse money to the employees if there were monies withheld. If there were no monies withheld for the contract, do not send the W-9 forms to the affected employees.

Request for Settlement

Within 30 days of service of the Notice of Withholding, the contractor may request a settlement meeting. The settlement meeting may be held in person or by telephone and must take place before the expiration of the 65-day period.

If the wage case is settled, headquarters will draft a settlement agreement for all parties to sign. Headquarters will send a cover letter and W-9 forms to the affected employees and entities for signatures.

Affected employees will have 30 days to return the W-9 forms. After 30 days, headquarters will send a disbursement memo to Accounting listing the employees and entities due money.

Accounting will forward checks to headquarters in 1-2 months, with a cover letter and tax responsibility form for affected employees and entities.

For additional details on this process, please refer to Section 21-5-1, “Settlement Meeting,” in this manual.

FIGURE 21‑A: WAGE CASE TIMELINE

Request for Hearing

For additional details on this process, please refer to the Request for Review Hearing subsection in the following section of this chapter.

Within 65 days of service of the Notice of Withholding, the contractor can submit a Request to Review Hearing letter to headquarters. Within 10 working days of the receipt of this request, headquarters will send the contractor the Notice of Opportunity to Request to Review Evidence letter to the contractor. Below is a template and a sample of this letter.

For additional details on this process, please refer to the Request to Review Evidence subsection in the following section of this chapter.

A prehearing and hearing date will be issued by the DIR upon receiving the notice of transmittal from the enforcing agency. For additional details on these processes, please refer to the Prehearing Conference and The Hearing subsections in the following section of this chapter.

21-4-4 Closing of the Wage Case

Once the wage case has been resolved by the administrative hearing process, settlement or non-response and closed, headquarters will notify the district. The district will bind, file the case, and retain it for 5 years, after which they will purge these files.

FIGURE 21‑B: WAGE CASE PROCEDURE

21-5 Administrative Hearing Process

The administrative hearing process includes the settlement meeting, the opportunity to review evidence, and the hearing. The administrative hearing process makes sure that the contractor is afforded due process before contract payments are permanently withheld.

21-5-1 Settlement Meeting

The “Notice of Withholding of Contractor Payments” notifies the contractor of their right to request a settlement meeting within 30 days of receipt of the “Notice of Withholding of Contractor Payments.”

An informal settlement meeting between the contractor and Caltrans may be held in person or by telephone and must take place before the expiration of the 60-day period plus 5 days for postal services. This meeting is conducted without the presence of a DIR hearing officer in accordance with California Code of Regulations, Title 8, Section 17221 (8 CCR 17221), “Opportunity for Early Settlement,” and California Labor Code Section 1742.1.

21-5-2 Request for Review Hearing

The contractor or subcontractor may request a review hearing within 60 days plus 5 days for postal services of receipt of "Notice of Withholding of Contractor Payments," in accordance with 8 CCR 17222, “Filing of Request for Review,” and California Labor Code Section 1742 (a). The contractor or subcontractor submits a Request for Review Hearing to the headquarters Division of Construction Labor Compliance wage case administrator.

The wage case administrator must:

- Keep the envelope containing the Request for Review Hearing showing the postmarked date.

- Submit the notice of transmittal, a copy of the hearing request, a copy of the "Notice of Withholding of Contractor Payments," and a copy of the Form CEM-2506, "Labor Compliance Wage Violation," to DIR’s lead hearing officer in Oakland, California, as soon as possible, informing them of the contractor’s request for a hearing.

21-5-3 Request to Review Evidence

Upon receiving the Request for a Review Hearing from the contractor or subcontractor, the headquarters Division of Construction Labor Compliance wage case administrator has 10 days from the receipt of the request to notify the affected contractor or subcontractor of its opportunity and the procedures for reviewing evidence to be used by the enforcing agency at the hearing.

The “Notice of Opportunity to Review Evidence" and the "Request to Review Evidence" is sent to the contractor in accordance with 8 CCR 17224, “Disclosure of Evidence.”

If a contractor requests to review evidence, they must sign and date the request and send it to the headquarters Division of Construction Labor Compliance wage case administrator address stated on the “Notice of Opportunity to Review Evidence Pursuant to Labor Code Section 1742(b).”

This district Labor Compliance officer is notified that the contractor has requested a review hearing and a review of evidence.

The headquarters Division of Construction Labor Compliance wage case administrator and the Legal Division will obtain copies of all documentation and prepare the case for hearing.

After a contractor is sent a "Notice of Withholding of Contract Payment," Caltrans is required to produce all the documentation it intends to present at hearing. Caltrans must strictly comply with statutory and regulatory timeframes in responding to a contractor's "Request to Review Evidence." The district Labor Compliance officer may be requested to provide additional documents and be called as a witness at the hearing.

21-5-4 Prehearing Conference

Upon receiving the notice of transmittal from Caltrans notification of the contractor’s request for review hearing, DIR will assign a hearing officer to the case and schedule a prehearing date for all parties to meet in a notification to Caltrans and all other affiliated parties listing the date, time and place of the prehearing conference.

At the prehearing conference, the assigned DIR hearing officer will discuss with both parties the option of a formal settlement meeting or if both parties agree, to move forward with a hearing on the merits.

21-5-5 The Hearing

A hearing may be conducted within 90 days of DIR’s receipt of the notice of transmittal. While experienced Labor Compliance officers may represent Caltrans at some DIR, the headquarters Division of Construction Labor Compliance office usually requests representation from the Legal Division if the contractor has retained an attorney.

The Labor Compliance officer may be called as a witness at the hearing and must remain available during the time established for the hearing. DIR hearings are informal and usually last no more than 2 days.

21-6 Debarment of Contractors

21-6-1 Introduction

Contractors are required to pay prevailing wages on public works contracts. Restitution is required if a contractor is found to have paid less than the prevailing wage. In addition, contractors are subject to sanctions for violating the California Labor Code. The most severe sanction is debarment. Debarment should be considered for repeat or egregious offenders.

21-6-2 State Legal Authority

Legal authority for debarring a contractor is in accordance with California Labor Code Section 1777.1, “Penalties for willful violations of chapter; Notice; Hearing,” which states two reasons for debarring a contractor:

- Section 1777.1(a) requires that a contractor or subcontractor on a public works project and violating public works law, except Section 1775.5, with intent to defraud may be debarred as long as 3 years. Debarment may result from any single violation if intent to defraud is proved.

- Section 1777.1(b) requires that a contractor or subcontractor working on a public works project and willfully violating the public works law, except Section 1775.5, may be debarred as long as 3 years for two or more separate willful violations within a three-year period.

In addition, 8 CCR 16800, “Definitions”; 8 CCR 16801, “Investigations: Duties, Responsibilities and Rights of the Parties”; and 8 CCR 16802, “Penalties,” provide additional legal authority to debar contractors from conducting business with Caltrans.

A debarment order may be taken against a contractor, or subcontractor, whether they have a written contract, an oral contract, a purchase order, or no contract. The intent of the law is to debar and prevent contractors from bidding on public works projects when they have been found to have committed any public works violation with the intent to defraud, or when they have committed more than one willful violation within a three-year period.

The DIR, Division of Labor Standards Enforcement has the authority to debar contractors from bidding on public works projects. Caltrans, through its approved labor compliance program, does not directly investigate the contractor for debarment, but can prepare a written complaint to the Division of Labor Standards Enforcement recommending debarment based on approved cases and a track record. This complaint is forwarded to DIR for a final determination.

21-6-3 Verification of Debarment Status

The alleged offending contractor’s standing can be checked through the federal and state debarment listings and contractor license. The debarment listings identify contractors ineligible to bid on or be awarded a public works contract because of a violation of the law or substandard contract performance. Use the following websites to determine debarment status:

- Labor Code violations: http://www.dir.ca.gov/dlse/debar.html

- Professionalism, law violations: http://www.cslb.ca.gov/

- Federal Excluded Parties Listing System, contract performance or law violations

21-6-4 Guidelines for Filing a Debarment Compliant

Guidelines for filing a debarment complaint are as follows:

- When the Labor Compliance officer determines that a contractor should be debarred for any of the reasons in California Labor Code Section 1777.1, the Labor Compliance officer should send the debarment recommendation to the Division of Construction Labor Compliance unit. The debarment recommendation should explain the contractor’s violations and should include the contractor’s position on the complaint, and the contractor’s explanations of any audit findings.

- The following documents should accompany the debarment recommendation:

- Contracts between the awarding body and the prime contractor

- Contracts between the prime contractor and subcontractors

- California State License Board information, including entity information

- Witnesses: affected workers and the Caltrans personnel

- The Caltrans inspector’s daily reports

- The prime contractor’s daily reports, if available

- Copies of all wage cases filed against the contractor

- The Division of Construction Labor Compliance unit must:

- Review and determine if other districts have similar complaints.

- Prepare a cover memorandum containing a recommended action based on review of the available facts regarding the contractor’s performance. The report should be one to two pages in length and contain the basis for the recommendation and a summary of Caltrans’ conclusion.

- Forward the request for debarment to the Legal Division for review.

- Submit the debarment request to the Division of Construction chief for signature.

- The Division of Construction chief forwards the request to the Division of Labor Standards Enforcement, Legal Unit. The Legal Unit reviews the report and initiates the debarment proceedings, if warranted. The contractor may contest the debarment at a debarment hearing. Caltrans staff may be called to present documentation of its position at the debarment hearing.

21-6-5 A Final Determination for Debarment

The investigation and final determination for debarment rests solely with the Division of Labor Standards Enforcement, Legal Unit. The Division of Labor Standards Enforcement, Legal Unit sends the final determination to Caltrans.

21-6-6 Federal Debarment

Legal authority for federal debarment of a contractor is provided by Code of Federal Regulations, Title 48, Section 9.4 (48 CFR 9.4), “Debarment, Suspension, and Ineligibility”; Executive Order 12549, “Debarment and Suspension”; 2 CFR Part 180, “OMB Guidelines to Agencies on Governmentwide Debarment and Suspension (Nonprocurement),” and DOT Order 4200.5G, “Suspension and Debarment, and Ineligibility Policies.”

Section 14 of the special provisions requires the prime contractor to certify under penalty of perjury that they are not currently debarred or have not been debarred within the past three years. It also states that the prime contractor must not enter into a lower tier covered transaction with any person who is debarred.

This suspension and debarment process applies to all federal-aid highway construction projects. Both processes are discretionary administrative actions taken to protect the federal government by excluding offending persons from participation in the federal assistance programs. A suspension and debarment action assures that the federal government does not conduct business with a contractor that has an unsatisfactory record of integrity and business ethics. The suspension and debarment actions are administered government-wide; a contractor excluded by one federal agency is excluded from doing business with any federal agency.

Causes for Federal Debarment

The primary causes for debarment may include:

- Conviction of, or civil judgment for, fraud or a criminal offense connection with a public or private agreement or transaction; violation of federal or state antitrust statutes such as price fixing, or bid rigging; embezzlement, theft, forgery, bribery, falsification or destruction of records, false statements, receiving stolen property, false claims, obstruction of justice; or any other offense indicating a lack of business integrity or business honesty that seriously and directly affects the present responsibility of a person.

- Violation of the terms of a public agreement or transaction so serious it affects the integrity of an agency program; that is, willful failure to perform, a history of failure or of unsatisfactory performance, or willful violation of a statutory or regulatory provision or requirement including any of the following causes: A procurement for example, federal lands, debarment by any federal agency; knowingly doing business with a debarred, suspended, ineligible, or voluntarily excluded person in connection with a covered transaction; failure to pay substantial outstanding debts; violation of a voluntary exclusion agreement or of any settlement of a debarment or suspension action; or any other cause of so serious or compelling a nature that it affects the present responsibility of a person.

Labor Compliance Manual Chapters

Chapter 1 - History, Laws and Regulations Governing Prevailing Wage Requirements

Chapter 2 - Governing Agencies

Chapter 3 - Caltrans Labor Compliance Program and Related Requirements

Chapter 4A - Division of Construction-Administered Contracts

Chapter 4B - Other Division-Administered Contracts

Chapter 5 - State Wage Determination

Chapter 6 - Federal Wage Determinations

Chapter 7 - Labor Compliance File

Chapter 8 - Pre-Job Conference Requirements and Posters

Chapter 9 - Determining Prevailing Wage Covered Work

Chapter 10 - Classification of Labor and Required Rates of Pay

Chapter 11 - Apprentice Requirements

Chapter 12 - Federal Trainee Requirements

Chapter 13 - Weekly Certified Payroll Records

Chapter 15 - Payroll Review and Confirmation

Chapter 17 - Notification Process

Chapter 18 - Employee Interviews and Equal Employment Opportunity (EEO) Compliance

Chapter 19 - Complaints Process

Chapter 20 - Audits and Investigations Process

Chapter 21 - Wage Case Submittal

Chapter 22 - Restitution Collection